- Forex Weekly Outlook October 9-13

The US economy lost 33,000 jobs in September due to the Hurricanes. While, this is lower than the 80,000 increase expected by most experts, unemployment rate improved to 4.2 percent, better than the 4.4 percent recorded in August. Meaning the labor market is still creating enough jobs to absorb market slack.

Also, sluggish wage growth picked up in September, rising to 2.9 percent year on year and 0.5 percent on a monthly basis. Indicating price pressure is gradually building up as projected by the Fed. Therefore, the odds of the Fed raising rate one more time this year should rise in days to come and dollar’s attractiveness surged.

This is because despite the fact that the labor market lost 33,000 jobs in September, services sector expanded at the fastest pace in 12 years and manufacturing sector grew at the fastest rate in 13 years with new orders jumping to 60.3 points, a 7-month high. Again, this shows the weak U.S. dollar has been fueling demands and the reason U.S. trade deficit improved to an 11-Month low.

Therefore, construction of the affected regions would further bolster job creation and economic outlook in the final quarter of the year.

In the UK, uncertainty plunged the pound to 3-week low after a group of Tory members opposed Prime Minister Theresa May continuity. This coupled with weak manufacturing and construction numbers hurt the pound attractiveness as investors doubted Theresa May’s ability to bring the party together at a very crucial moment of Brexit negotiation.

Also, while services sector grew unexpectedly amid rising uncertainties, weak construction growth, low manufacturing number, and low new business investment would impact growth going forward as it would cast doubt on the possibility of the Bank of England to raise borrowing cost when wages and jobs are expected to drop amid weak economic fundamentals.

In the Euro-area, strong economic growth continues to support the Euro single currency but uncertainties surrounding Spain-Catalonia relationship and Germany politics continued to impact the region outlook. However, the economic numbers remained strong with the services sector growing at a steady pace in September while manufacturing jumped to almost 7-month high. Meaning improved global economic outlook continues to support growth as witnessed in the German factory orders in August. When orders jumped to 3.6 percent from a revised 0.4 percent decline in July.

The region is projected to grow at the fastest pace in a decade in 2017 and expected to sustain current progress in the final quarter.

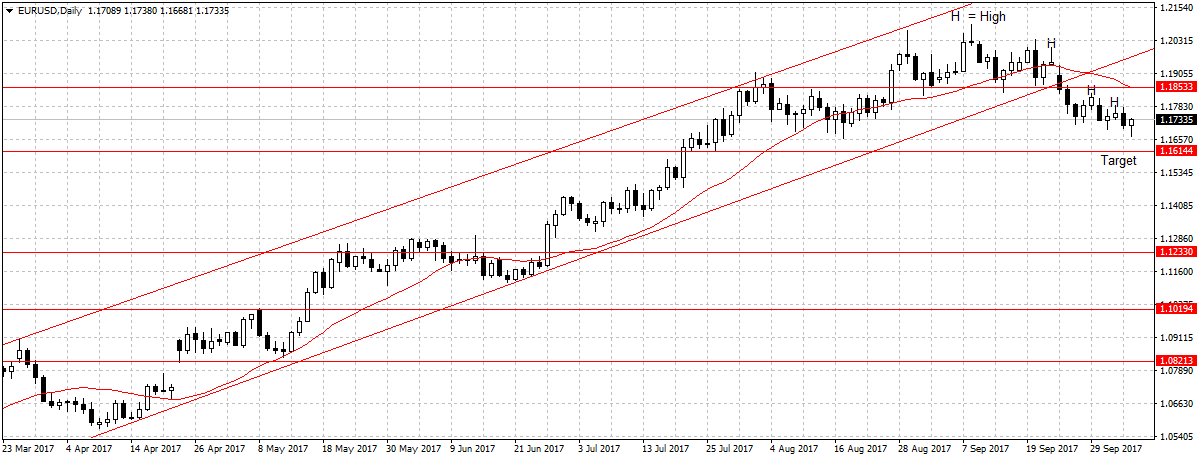

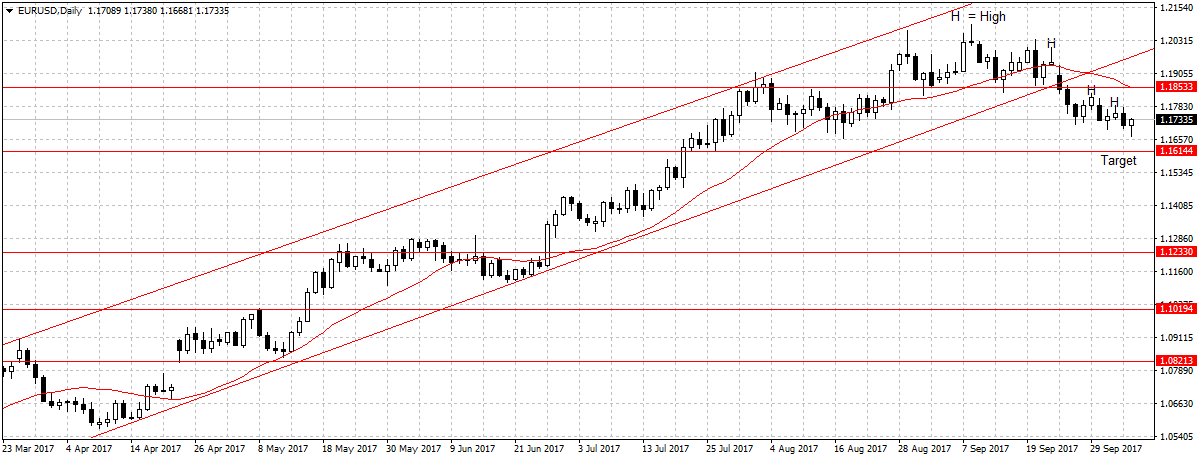

EURUSD

The EURUSD has gained about 8 percent in 2017 alone. However, uncertainties in Euro-area has started weighing on Euro currency. For instance, since the German election two weeks ago this pair has lost 202 pips to pare gains from 12 percent to 8 percent. Currently, Catalonia is threatening the Spanish government it would declare independence on Monday. These growing uncertainties are what is affecting the Euro economic sentiment and eventually weigh on the attractiveness of the currency.

This is similar to what happened to the U.S. dollar during the missile threat between the U.S and North Korea, economic fundamentals were strong with the second quarter GDP growing at 3.1 percent. Yet the U.S. dollar lost about 13 percent against the Euro common currency.

While I have avoided this currency due to Trump’s impulsive comments that have over time overhaul analysis and change market direction. I think the consistency of recent sell signals have validated bearish continuation, even though the pair rebounded slightly on Friday. I believe once the markets digest job report, especially with earning rising to 2.9 percent and the odds of the Fed raising rates surged. The dollar attractiveness will increase.

Also, the low highs, as shown above, reinforce why the price is trading below 20-day moving average in the last 10 days. Buyers have lost interest and attention would likely be on the downside.

Therefore, I am bearish on this pair as long as price remains below 1.1853 price level that doubled as 20-day moving average with 1.1614 as the target.

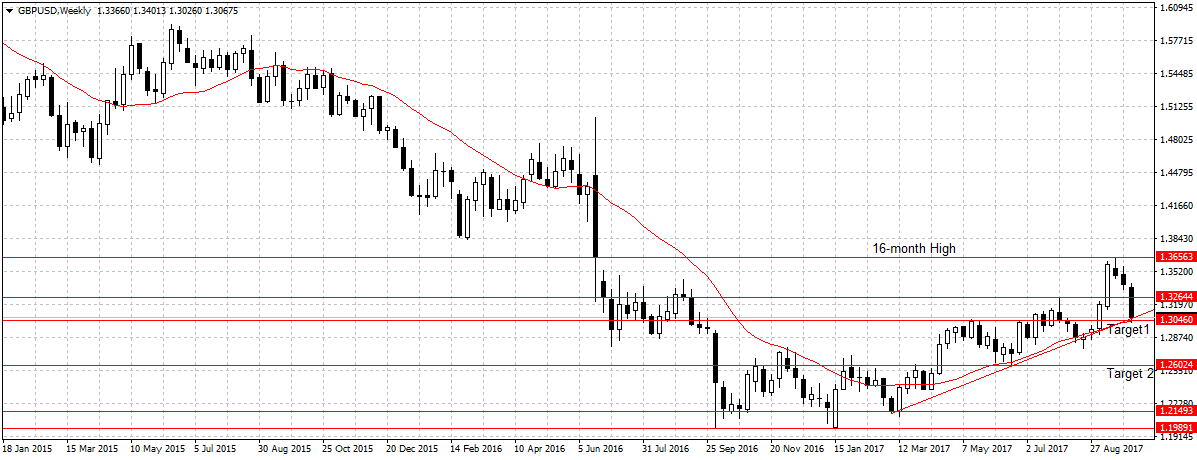

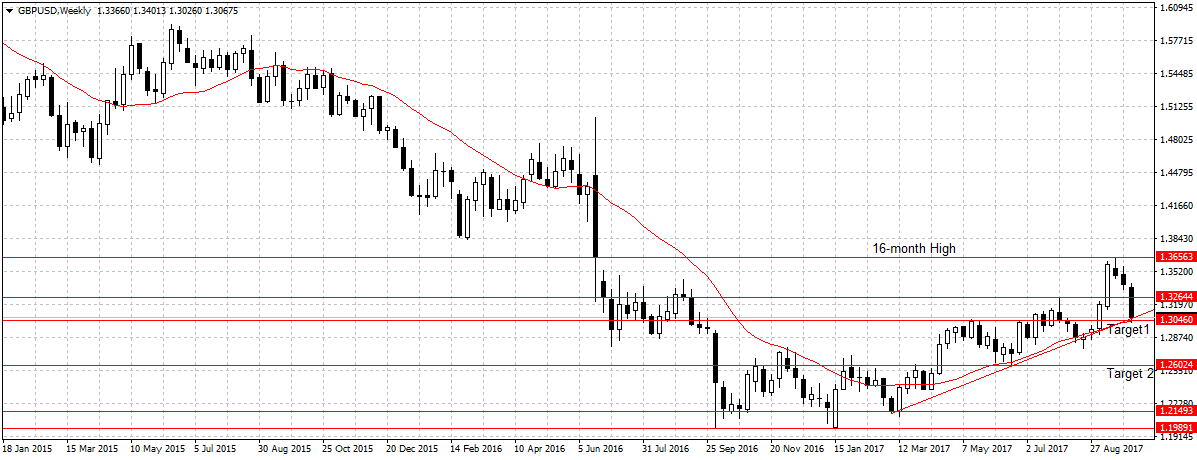

GBPUSD

The U.K. key economic sectors plunged last month with only the services sector growing unexpectedly. The uncertainty in the country has started affecting the Pound attractiveness as investment and job creation in key sectors showed signs of slowing down in September. All these coupled with the new attack on Theresa May by her own party members would further affect the U.K. economic outlook and the Pound going forward.

Therefore, this week I will expect a sustained break of 1.3048 support level that doubled as the 20-day moving average and below the trend line to reaffirm bearish continuation for 1.2602 targets as explained during the week.

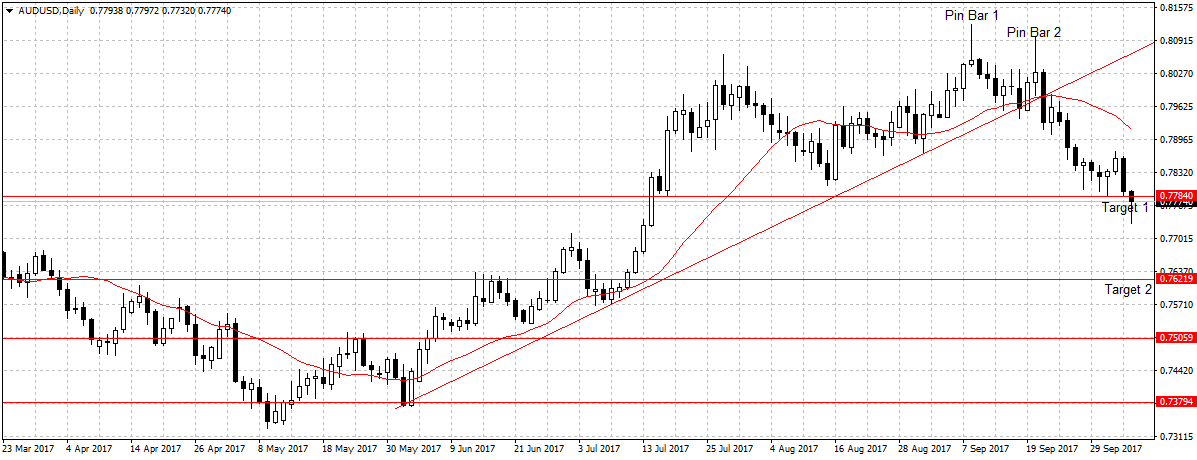

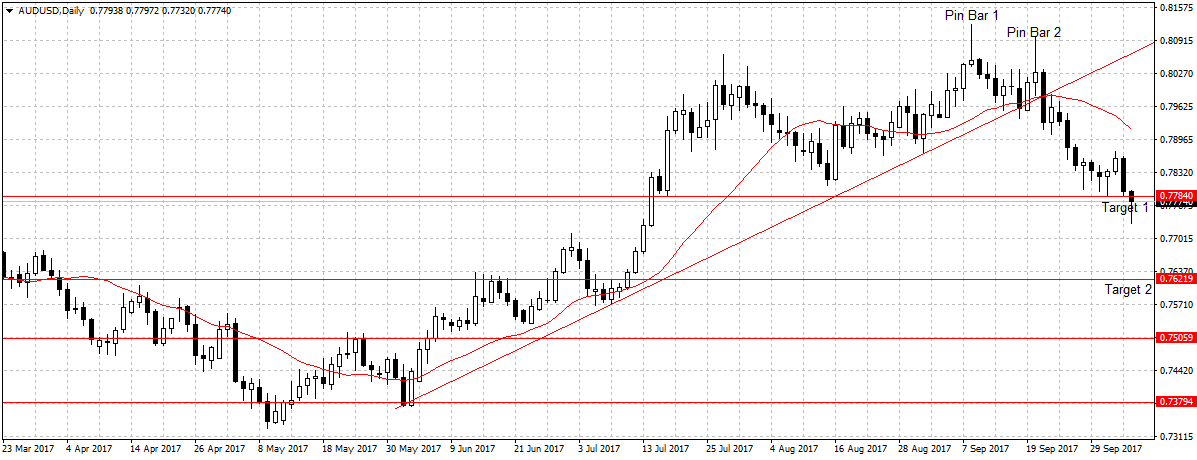

AUDUSD

Since I first mentioned this pair in September it has lost 350 pips and last week closed below our first target at 0.7784. While weak iron ore price continues to weigh on Australian dollar outlook the currency retraced slightly against the US dollar on Friday after job report.

However, with the US strong economic data and the odds of the Fed raising rates increasing, this pair is expected to sustain its downward move this week towards our second target as explained in the previous analysis.

Therefore, we remain bearish on AUDUSD and expect a sustained break of 0.7784 targets to open up 0.7621 support level in days to come. The Australian dollar is overpriced, and as stated by the Governor of Reserve Bank of Australia, Philip Lowe, high foreign exchange rates would hurt economic progress. Excerpt from an earlier analysis.

Therefore, this week I will look to sell below 0.7784, our target one, for 0.7621 target 2.

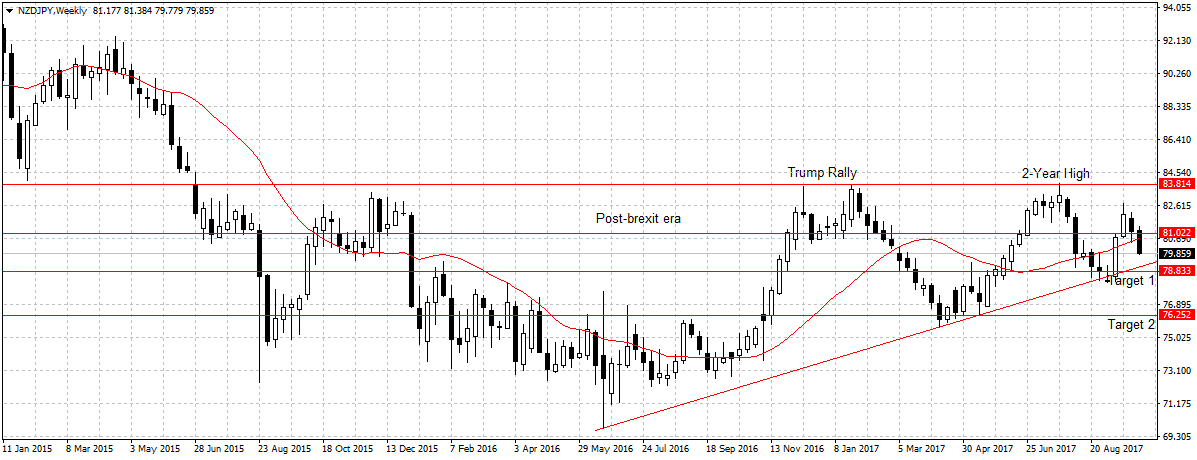

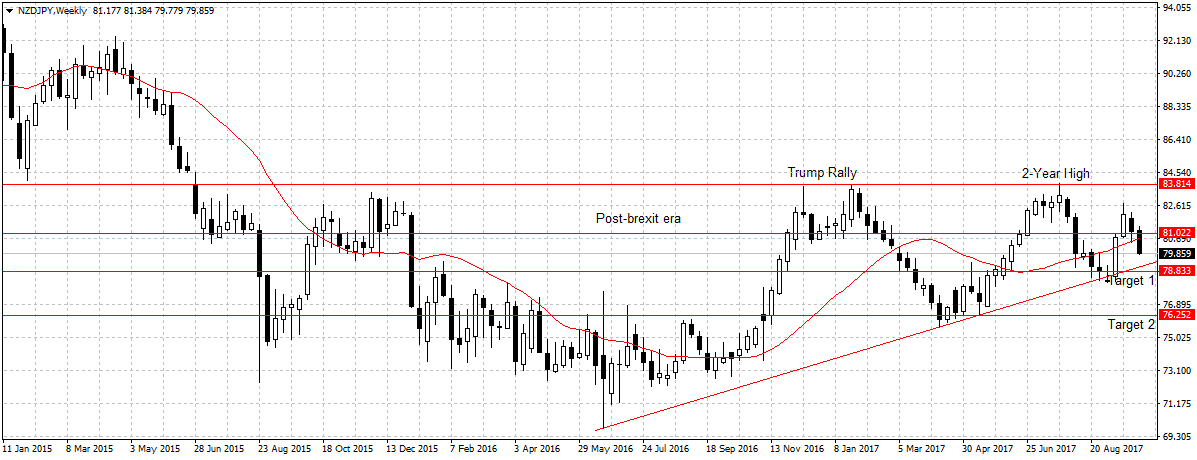

NZDJPY

Just like the Australian economy, the New Zealand economy is predicted to be affected by the China’s new credit policy and economic transformation. While Japan’s economy, on the other hand, grew at 2.5 percent rate with exports picking up. The New Zealand exports and economic growth are likely to be hurt by the limited credit policy in China, its largest trading partner.

Again, this pair retraced after closing below our key support, 78.83, which doubles as our first target six weeks ago. But the early September missile threat that weakens the Yen outlook and halted bearish continuation bolstered the attractiveness of haven assets like the New Zealand dollar.

However, with the odds of the Fed raising interest rates increasing, emerging economies like New Zealand are going to experience capital flight. This would impact the attractiveness of the New Zealand dollar. This week, I remain bearish on this pair with 78.83 as the target and will expect a sustained break of that support level to open up 76.25 target 2.

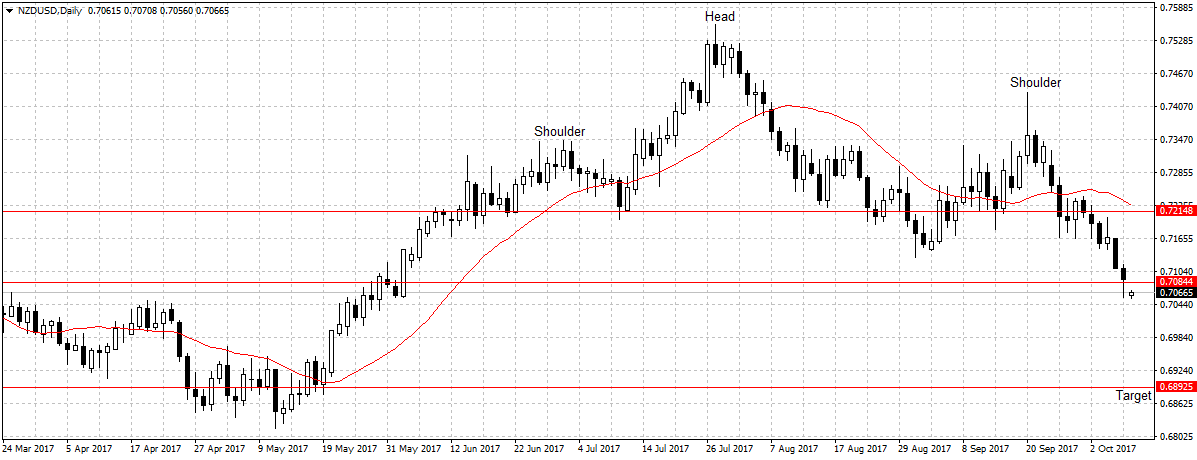

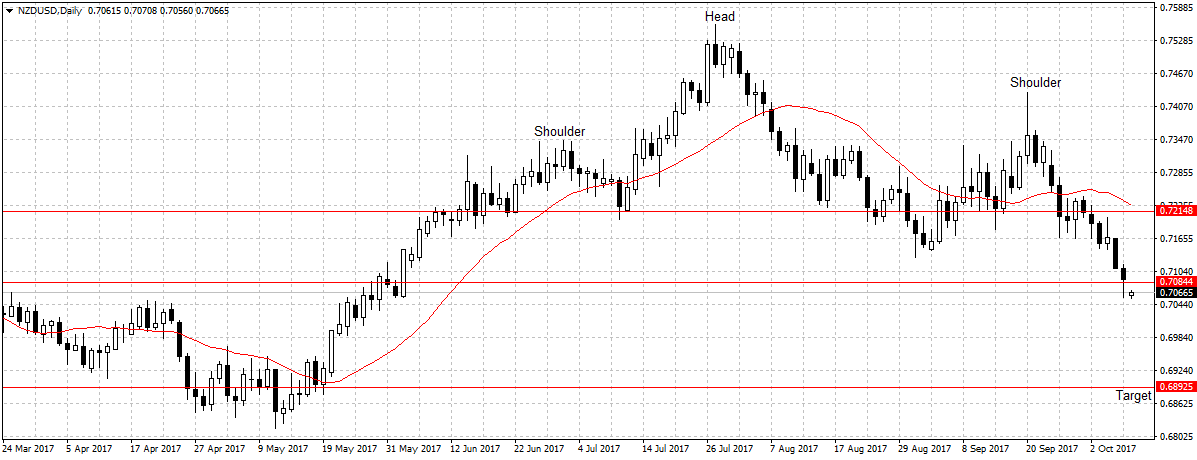

NZDUSD

As explained last week, a sustained break below our first target of 0.7084 would reaffirm bearish continuation and open up 0.6892 support level.

Therefore, with the renewed interest in the US dollar I remain bearish on this pair and will look to sell below 0.7084 for 0.6892 targets.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago