- Federal Reserve Meeting: What Investors Will Be Looking For on Wednesday

As the market awaits Federal Reserve economic projection and interest rate decision on Wednesday. Investors will be looking to assess the damage done by Hurricanes in order to price it in and better project balance sheet normalization commencement or if the apex bank will hike rate one more time this year.

Also, investors will like to know when the apex bank expect full recovery of the affected areas. This is important as it will reveal the extent of damage done to refineries and if these damages would ease global oil glut and boost gasoline cost. The reason inflation rate rose 1.9 percent in August.

Similarly, the uncertainty surrounding tax cut and growing nuclear threat are impacting the US market and capital inflow. Therefore, the market would like to know the Federal Reserve approach at containing these uncertainties and how it plans to revamp business confidence, as investors and businesses are unclear if the proposed tax cut would materialize as promised.

The Federal Reserve is expected to maintain current Federal Funds Rate of 1.25 percent but investors will be looking for a clue on the next rate hike or impact of damages to the current economic forecast.

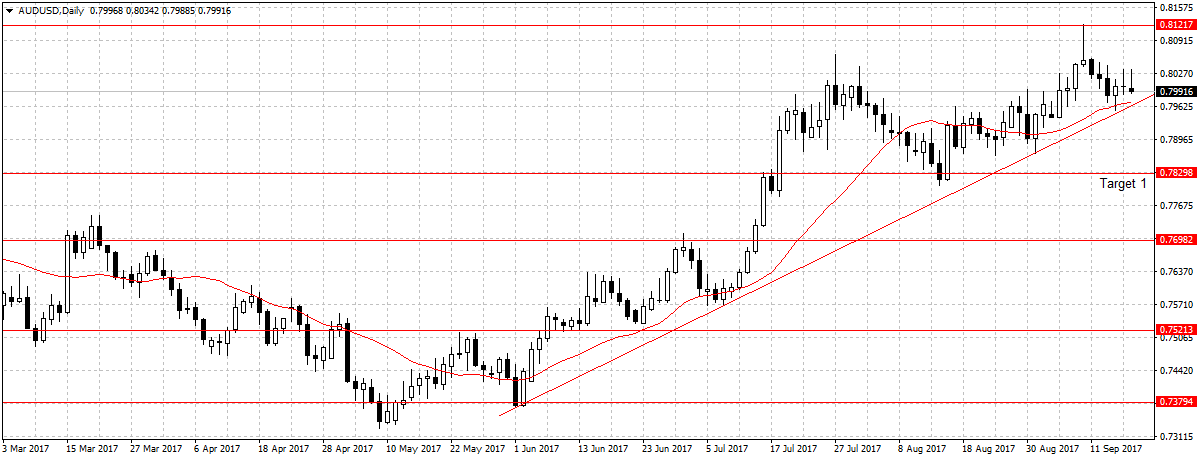

A clear-cut economic projection will boost US business confidence and aid US dollar attractiveness, especially on balance sheet normalization. If this happened the AUDUSD attractiveness will increase and likely break the support 0.7962 towards 0.7829 targets as explained in the forex weekly outlook.