- AfDB Urges Greater Focus on Implementation, as African Green Revolution Forum Begins

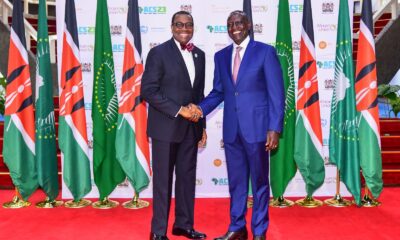

Ahead of the 2017 African Green Revolution Forum (AGRF), the President of the African Development Bank (AfDB), Akinwumi Adesina, has called for greater attention to be paid to the implementation of concrete plans for achieving the green revolution in Africa.

The seventh African Green Revolution Forum, taking place in Abidjan, Côte d’Ivoire, from September 4 to 8, will focus on ‘Accelerating Africa’s Path to Prosperity: Growing Economies and Jobs through Agriculture’.

The Forum is hosted by the Alliance for a Green Revolution in Africa (AGRA), an African-led institution focused on putting farmers at the centre of the continent’s growing economies. AGRA is built on an alliance of partners that care about, commit to and invest in Africa’s agricultural transformation.

AGRF partners include the African Development Bank, the African Union, the African Fertiliser and Agribusiness Partnership (AFAP), AGRA, the Food and Agricultural Organisation of the United Nations (FAO), the International Fund for Agricultural Development (IFAD), Mastercard Foundation, the New Partnership for Africa’s Development (NEPAD), OCP Africa Group, the Rockefeller Foundation, the Southern African Confederation of Agricultural Unions (SACAU), Syngenta, and YARA International.

The African Development Bank is proud to be a partner in the Forum in Abidjan. “As we all converge on Abidjan for this year’s African Green Revolution Forum, our focus should be on implementation,” Akinwumi Adesina, President of the AfDB, said in a video statement.

Adesina noted that this year’s Forum comes as some African nations are witnessing drought and heightened food insecurity. He stressed that the event presents an opportunity to push efforts to make Africa self-sufficient in food production and transform agriculture into a wealth-creating sector.

“Agriculture is booming in Africa and holds the greatest opportunity to boost African economies, build rural economies, lift millions out of poverty, and create jobs,” he said.

AfDB is accelerating this development through its Feed Africa Strategy with planned investment of $24 billion over the next 10 years. The Bank invites partners, governments, private sector, and development institutions to work together to make this happen.

This year’s African Green Revolution Forum, considered to be the most important meeting on African agriculture, will be held under the patronage of the President of Côte d’Ivoire, Alassane Ouattara.

The Forum is expected to bring experts and other stakeholders together to ensure that the importance of agriculture to African economies is not overlooked. Agriculture represents more than 70 per cent of employment; making it essential to delivering on economic development visions for the continent and achieving the Sustainable Development Goals.

The sixth African Green Revolution Forum (AGRF) was held in Nairobi, Kenya, in September 2016 and attracted more than 1,500 delegates from 40 countries.

At AGRF 2016, many of Africa’s steadfast champions of agriculture pledged more than $30 billion in investments to increase production, income and employment for smallholder farmers and local African agriculture businesses over the next 10 years.

AfDB is leading a campaign to unlock the continent’s food and agriculture market, which is projected to hit $1 trillion by 2030. In the words of the AfDB President: “We must hurry. Africa’s time to become the global powerhouse for food and agriculture is now. We are already late.”

Forex2 weeks ago

Forex2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Company News4 weeks ago

Company News4 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Nigerian Exchange Limited4 weeks ago

Nigerian Exchange Limited4 weeks ago