- Forex Weekly Outlook July 31- August 4

The US economic data showed the economy is healthy and expanded 2.6 percent in the second quarter. However, the US dollar dipped against most currencies, mainly because of the ongoing political tussle in the US and North Korea successful test of an ICBM capable of delivering a nuclear warhead to the US.

Again, while the Federal Open Market Committee (FOMC) announced its readiness to commence balance sheet normalization as soon as October, it also voiced its concern on weak inflation rate and the need for the apex bank to move gradually as previously stated. This further cast doubt on the widely expected rates decision by both investors and the markets.

However, the weak US dollar boosted exports to 4.1 percent in the second quarter, while consumer spending surged to 2.8 percent. Riding on solid job data and steady wage growth. Suggesting that the weak US dollar is aiding businesses –especially the manufacturing sector. A move most experts believed could continue to support the sector if Trump’s proposed tax cut failed.

In Australia, the Aussie dollar dropped slightly after data showed inflation rate rose 0.2 percent in the second quarter, down from 0.5 percent recorded in the first quarter. Signaling that despite the surge in the Aussie dollar value, the Reserve Bank of Australia, RBA, would not be raising rate soon.

This was after the RBA Governor Philip Lowe’s said the weak consumer prices was due to slow growth in wages. Even though unemployment rate was at a record low, wage growth has been on the decline alongside future expectations. Dragging down household consumptions as data showed households revised down their expectations of future income growth. This is the slowest wage growth since 1997.

In the UK, the International Monetary Fund revised down UK’s economic growth projection for 2017 to 1.7 percent, citing rising inflation rate and increased headwinds. Likewise, consumer confidence plunged to post Brexit low. Suggesting consumers are starting to doubt future growth amid Brexit.

In Canada, the economy expanded by 0.6 percent, up from 0.2 percent. However, the Canadian dollar has struggled to sustain its Trump’s rally, even with a surge in its manufacturing activities and a healthy labour market. Indicating that the uncertainty in the global oil market and US business atmosphere is weighing on Canadian dollar outlook.

This week, USDCAD and GBPCAD top my list.

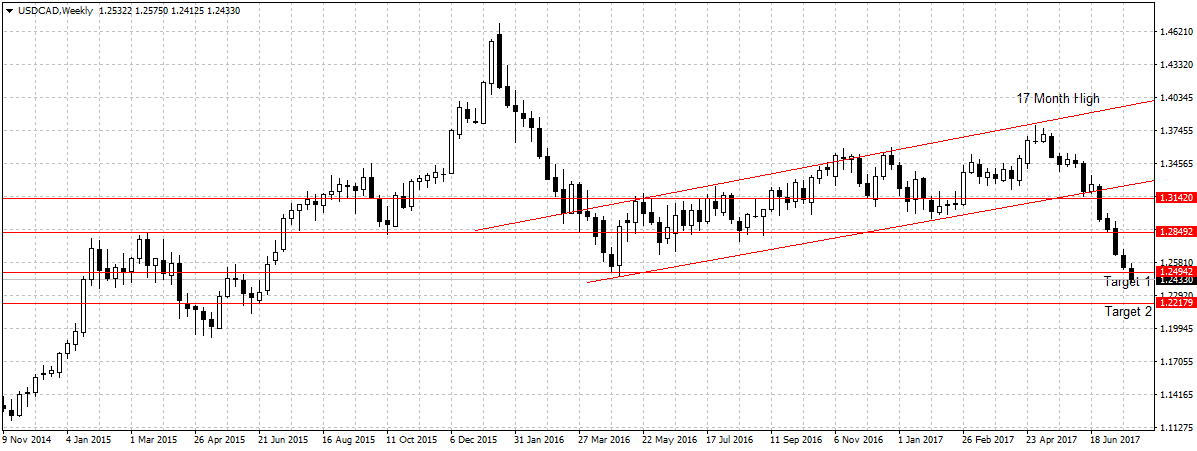

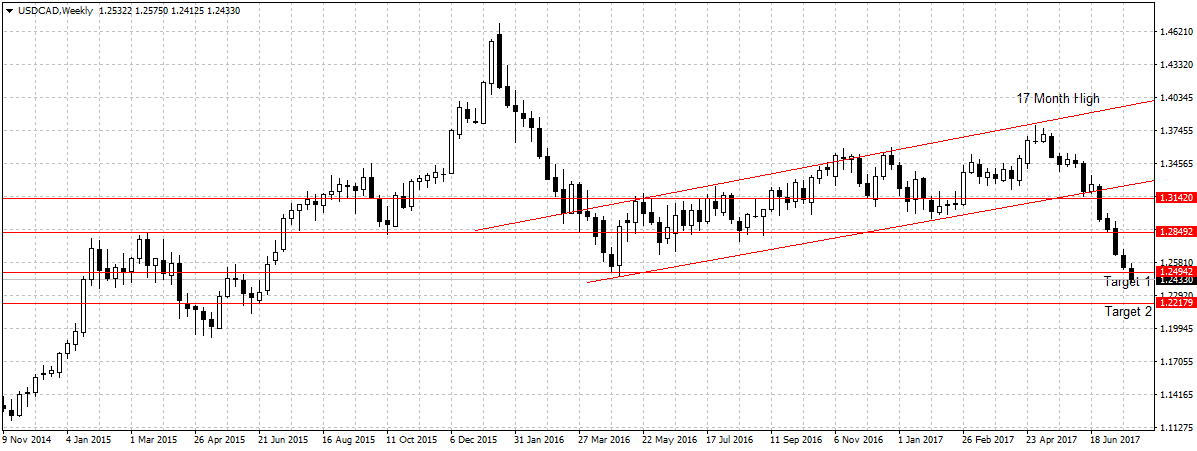

USDCAD

After our first target was hit last week, this pair continues its bearish run breaking a two-year support level. This sustained break would attract more sellers, especially after data revealed the Canadian economy expanded better than projected.

Past week quote; Technically, the bearish flag pattern started in Jan 2016 signifies bearish breakout after closing below 1.3142 three weeks ago but affirmed bearish continuation following a sustained break of 1.2849 support level last week. Therefore, this week I will be expecting USDCAD to sustain current bearish move with 1.2494 as the first target. A sustained break of 1.2494 support levels should open up 1.2217.

Therefore, this week I will be adding to my sell order for 1.2217 targets.

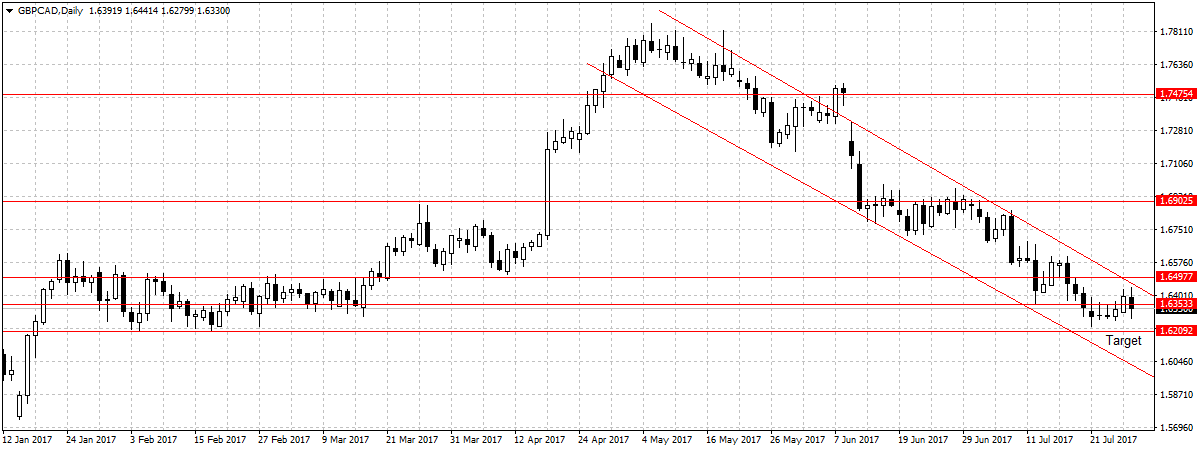

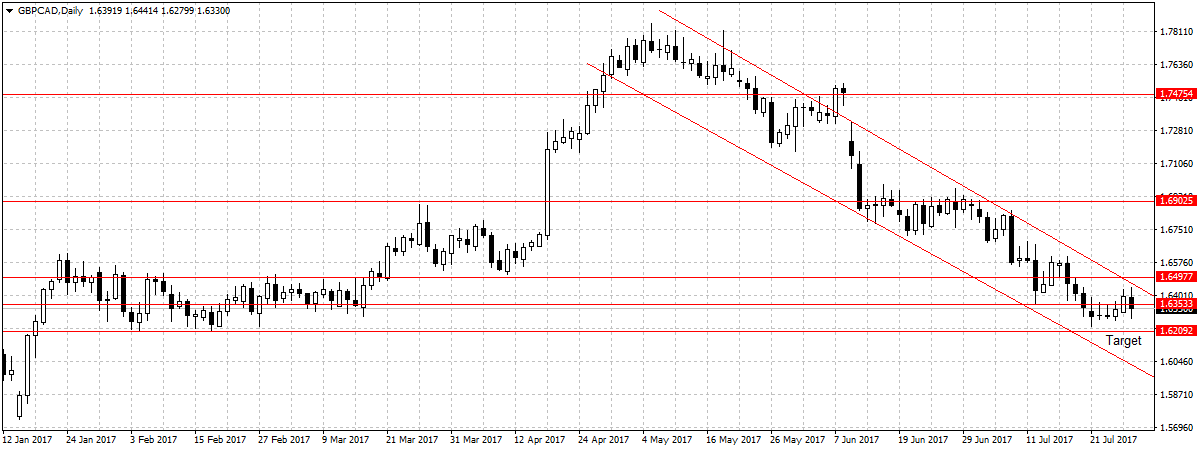

GBPCAD

Since I mentioned this pair three weeks ago, it has plunged by 248 pips. Hitting our target 1 and 2.

However, with the growing weak business confidence in the U.K and low new investments. This pair is expected to continue its downward trend as long as 1.6497 resistance holds.

Past week quote; This is because the U.K. economy has started slowing down as the political uncertainty in the region worsen after Theresa May failed to win majority votes in June.

On the other hand, the Canadian dollar gained from growing labor market and improving manufacturing sector.

Therefore, I will be looking to sell for 1.6209 targets.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Economy4 weeks ago

Economy4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Business3 weeks ago

Business3 weeks ago