- Fayemi Briefs Buhari on $150m W’Bank Mining Loan

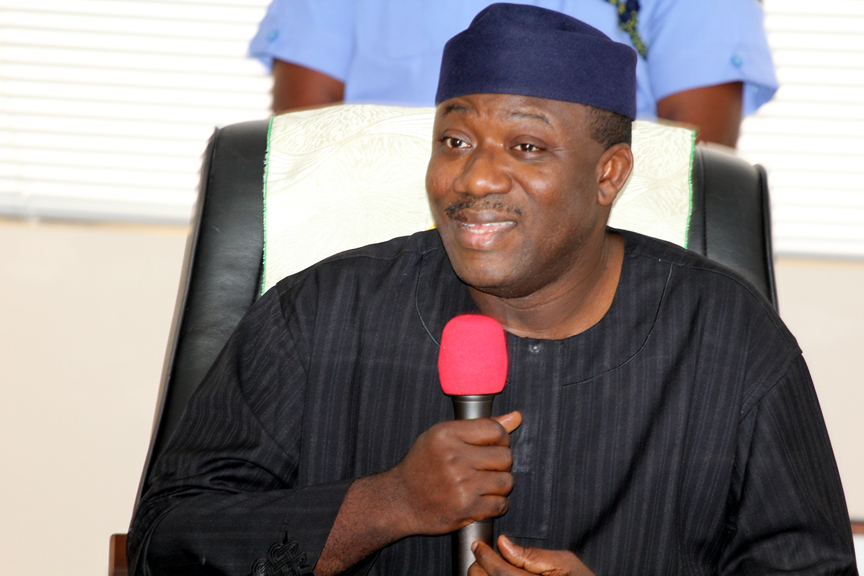

The Minister of Solid Mineral Development, Dr. Kayode Fayemi, on Thursday informed President Muhammadu Buhari of the $150m loan approved by the World Bank for the country’s mining sector.

Fayemi also used the opportunity of the meeting to update the President of his ministry’s efforts at curtailing the activities of illegal miners.

Speaking with State House correspondents at the end of the meeting, Fayemi said a lot of positive developments were taking place in the sector.

The minister said, “I have come to brief the President about what is going on in the mining sector and to particularly inform him of the major breakthrough we had on Friday with the World Bank approving the $150m request that we made to them during a meeting in Washington DC.

“I also briefed him on the activities of illegal miners and the work we are doing with regards to that, and my tour around the country and the gradual improvements we are beginning to see in the sector, particularly in relation to our growth.”

He added, “It is a sector that seems to have defied recession. According to the National Bureau of Statistics, it is growing while other sectors may be experiencing challenges.

“That is not to say that we have reached Eldorado. It is a journey and we are beginning to see concrete developments, and the President, as you know, also approved an intervention fund for this sector, the first of its kind in the history of the mining sector. We also discussed that.”

Fayemi said the government would spend the loan on areas such as geological data gathering and the organisation of the informal sector, adding that it was attractive, coming at one per cent interest rate and 30 years moratorium.

He added, “Geological data is very important to us, and part of this money is going to assist with geological data. It is also going to contribute to our organising the informal sector into a formal sector, providing some access to funding and helping them with technological equipment for the artisanal miners.

“There are many miners who have done extensive exploration, but to move to production has been a challenge. So, for those who are crossing over from exploration to exploitation, and to actual mining, we believe that giving them some assistance will help boost the industry, particularly the small and medium-scale players in the industry.”

On concerns over the nation’s increasing foreign loans, Fayemi said they could be valid if Nigeria was borrowing to pay salaries or to attend to recurrent expenditure.

He noted that it made sense if the country was borrowing to develop a sector that had a potential for exponential growth and multiplier effect on other sectors, particularly industrialisation.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago