- Falling Oil Prices Threaten Nigeria’s Earnings, Reserves Accretion

The steady rise of Nigeria’s foreign exchange earnings and build-up of external reserves, which started about five months ago, is already under threat from exogenous shock arising from the recent fall in oil prices.

Nigeria depends on oil sales for 90 per cent of its foreign exchange earnings and 70 per cent of total revenue.

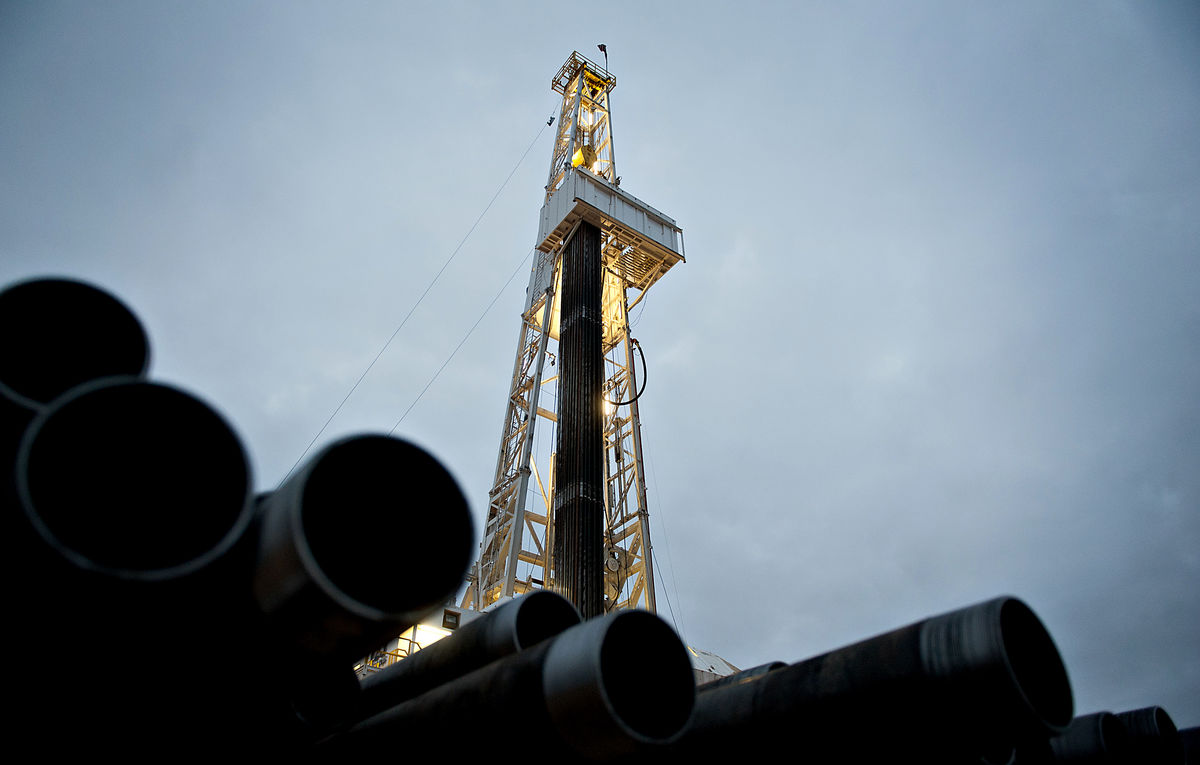

However, rising shale oil production in the United States in recent months has dampened production cuts carried out by members of the Organisation of Petroleum Exporting Countries (OPEC) and Russia to shore up prices.

According to Reuters, oil prices slid 2 per cent on Thursday, extending the previous session’s dive that brought prices to the lowest levels this year, as record U.S. crude inventories fed doubts about whether OPEC-led supply cuts would reduce a global glut.

U.S. crude prices fell through the $50 a barrel support level, with market participants unwinding a massive number of bullish wagers they had amassed after a deal by top global oil producers to limit output.

On Wednesday, crude also tumbled more than 5 per cent, its steepest dive in a year, after data showed crude oil stocks in the U.S., the world’s top oil consumer, swelled by 8.2 million barrels last week to a record 528.4 million barrels, well above forecasts of a 2 million barrel build.

Although the impact of sliding oil prices are yet to be felt in Nigeria, market analysts have cautioned that the external shocks would eventually hit the country’s foreign earnings and reserves.

Last Thursday, Nigeria’s external reserves rose to $30.039 billion, according to the latest data from the Central Bank of Nigeria (CBN).

The central bank’s data showed that the reserves, derived primarily from oil sales, recorded a steady increase of between 2.3 and 2.75 per cent since January 2017.

Other than oil prices, a drop in militancy in the Niger Delta has also led to an improvement in the country’s foreign exchange earnings.

However, following the recent changes in the CBN’s foreign exchange (FX) policy and its renewed bid to reduce the gap between the interbank and parallel market rates, there have been increased interventions in the FX market by the central bank.

So far, the CBN has pumped $1.370 billion into the FX market since the measures were announced.

Owing to this, Nigeria’s external reserves, which give the CBN its firepower, have come under close scrutiny.

The naira closed at N463 to the dollar at some parallel market points on Friday.

At $30.039 billion, the country’s reserves have increased by $4.196 billion or 16 per cent, compared with the $25.843 billion at the end of 2016.

But concerns continue to heighten over the central bank’s ability to sustain its intervention in the market with the oil prices recording their biggest fall this year last week.

Speaking in a chat on Sunday, the Director General of the West African Institute of Financial and Economic Management (WAIFEM), Prof. Akpan Ekpo, pointed out that if oil prices continue to slide, it would definitely have a negative effect on the country’s external reserves.

“Let’s just hope that it rises again. That is why we have always said that the price of oil is very volatile. That is why you cannot depend on it for long-term development.

“Certainly, if this continues, it would affect the amount of dollars the CBN can put in the market.

“That is why some people have been asking if what the CBN has been doing in the past three weeks is sustainable.

“Effectively, in the long term, the structure of the Nigerian economy has to change towards earning FX from other sources instead of crude oil. We must also understand that the U.S. has stopped buying our oil because of the shale oil produced in the country,” Ekpo added.

The Financial Derivatives Company Limited stated in a recent note that the ability of the CBN to sustain its fight against currency speculation as well as preserve the value of the naira would depend largely on the country’s crude oil earnings.

Despite mounting concerns, there were indications at the weekend that the CBN would inject more FX into the market early this week.

Information about the central bank’s action became rife over the weekend, sending jitters among currency speculators.

When contacted, the acting Director, Corporate Communications of the CBN, Mr. Isaac Okorafor, confirmed that the central bank was determined to sustain liquidity in the FX market this week in order to enhance accessibility for genuine end-users.

Okorafor also cautioned dealers in FX not to engage in any unwholesome practices detrimental to the smooth operations in the market, warning that the CBN would impose heavy sanctions on any organisation or official involved in such acts.

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Travel4 weeks ago

Travel4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Naira3 weeks ago

Naira3 weeks ago