- Geospatial Technology’ll Grow Nigeria’s Economy by $3bn

The Ordnance Survey of Great Britain has said Nigeria will grow its economy by $3bn through the adequate deployment of geospatial technology.

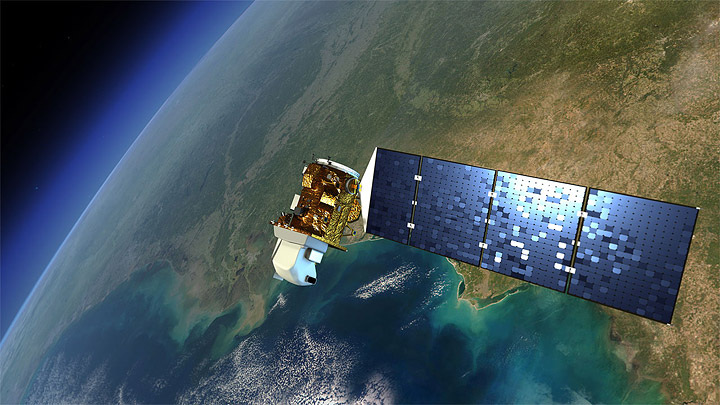

Geospatial technology refers to all of the technology used to acquire, manipulate, and store geographic information.

The surveying arm of the United Kingdom further stated that with the right investment in the Office of the Surveyor-General of the Federation in Nigeria, the country would increase its income streams as it strives to diversify its economy.

The Director, Strategic Relations, Ordinance Survey International, Mr. John Kedar, disclosed this during a visit to the OSGOF in Abuja, as he stated that the visit was aimed at establishing a partnership between the United Kingdom and Nigeria on the deployment of latest geospatial technology domestically.

He said, “This partnership is very important if you think about the value of what the Office of the Surveyor-General of the Federation brings to Nigeria.

It could, if everything works according to plan, generate $3bn extra to the Nigerian economy. It takes time to do something like this but the journey we are beginning now is a way of helping to start that and a way of helping to get the benefits to Nigeria.

“This might not happen quickly because you’ve got to generate really high quality data and you must use it. For instance, think about the use of geospatial data in the logistics business and the delivery of items anywhere. If you always get your items to the right place and at the right time, this saves money and there are lots of other ways to generate benefits from geospatial data.”

When asked if Nigeria had the potential to grow its geospatial survey operations to generate such funds, Kedar replied, “You have a growing economy. Your economy is growing incredibly fast with a lot of skilled people and therefore you do have the potential, absolutely!”

He, however, urged the Federal Government to invest in the OSGOF so as to generate enough geospatial data needed in securing the country and its assets, particularly in the oil and gas sector.

“Nigeria is definitely on the right path, but you’ve got to invest in the geospatial capability. So the OSGOF needs investments in order to create the data and help the nation in the area of logistics, for security, digital businesses and also in the security of pipelines,” Kedar said.

In his reaction, the Surveyor-General of the Federation, Mr. Ebisintei Awudu, stated that the visit had shown the OSGOF how to generate revenue using geospatial techniques.

He said, “The benefit of this visit is that Ordnance Survey of Great Britain has brought its technology and the way they’ve been doing things in the last 225 years to the Office of the Surveyor-General of the Federation which is currently undergoing many restructuring in different areas. This is to enable us provide the required geospatial needs of this country for good governance, security and all other sectors of the economy.

“It is very possible to generate more revenue using geospatial survey based on what we’ve learnt from them but that is if we have seed money. For if we have seed money this office can generate some good amount of revenue, it might not be up to what they generate but I think we can do quite a lot.”

Awudu added, “We are likely to get to the standard that they’ve attained in geospatial technology and it is not too far because technology changes almost every six months. So we can get there. What we need is some little encouragement in terms of adequate training and funding.”

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira3 weeks ago

Naira3 weeks ago

Naira4 weeks ago

Naira4 weeks ago