- Local Production Suffers Setback on Dollarisation of Raw Materials

The Federal Government’s efforts at diversifying the economy and reducing dependence on importation are being undermined by value-chain operators, farmers and providers of key raw materials who would rather export raw commodities for foreign exchange than sell to local producers at market prices.

The hot chase for forex by farmers and other raw material providers outside of government control will lead to higher prices, especially as scarcity and demand from neighbouring countries put pressure on local supply.

Local manufacturers say raw commodities like cotton, grains and natural gas, among others are being offered to local manufacturers at prevailing international market prices and payment being demanded in foreign exchange even as the materials are being harvested and produced domestically.

Operators noted that successes recorded by government intervention in some key industries might be eroded if access to raw materials was not guaranteed. This means that consumers may pay more for even locally-produced goods if the ugly trend is not checked.

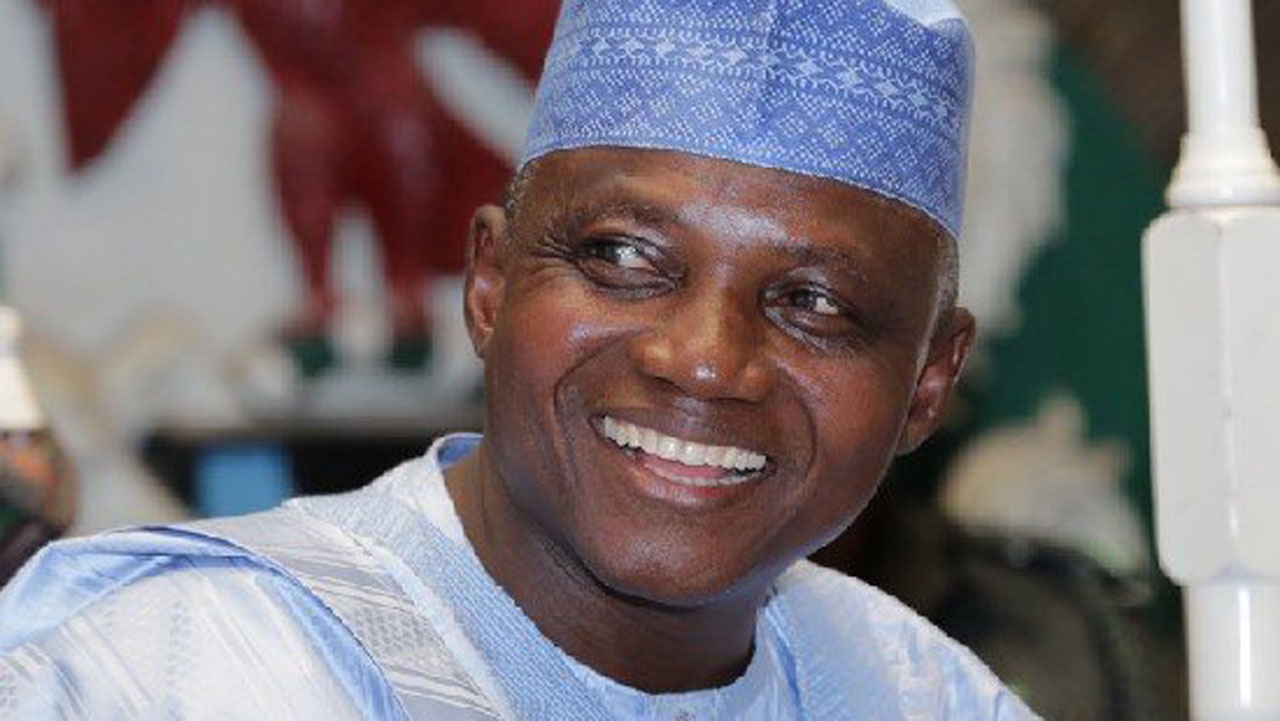

The Senior Special Assistant on Media and Publicity to the President, Garba Shehu, had raised the alarm that the country currently risks famine from early next year due to the huge export of the country’s grains to attract foreign exchange, even when local demands have not been met.

With the exception of organisations that deployed out-grower schemes to develop their value-chain capacity, other operators have had to depend on imports subject to availability of foreign exchange or depend on open market where prices are arbitrarily determined by farmers and value-chain operators.

The President of the Manufacturers Association of Nigeria (MAN), Dr. Frank Jacobs, explained that manufacturers have begun to look inwards for raw materials sourcing since access to foreign exchange has become limited. The idea of ‘looking inwards’ for raw materials is to sustain operations, leading to poor capacity utilisation. He argued that suppliers’ penchant for across-the-border sales is frustrating manufacturers looking to source raw materials locally.

Manufacturers are worried that government, which recently reported glut in grains and farmers’ inclination to sell to foreigners, has not evolved an efficient interventionist policy to mop up the excess and guarantee future supplies in event of famine.

The Ministry of Agriculture could not confirm immediate plans to revive marketing boards. The Guardian could not reach Minister Audu Ogbeh on his mobile phone. His media aide, Dr. Olukayode Oyeleye, instead offered to provide details on Monday (today). Marketing board is a stop-gap mechanism to ensure supplies and stabilize price between planting seasons.3w

The President of the Nigerian Textile Manufacturers Association (NTMA), Mrs. Grace Adereti, canvassed the revival of the Commodities Board as a measure to ease textile manufacturers’ access to raw materials for production.

Lamenting the present situation, Aderetin said: “When we contacted the farmers, they said that they are not ready to supply to us at the price negotiated by the ginners. Further inquiry showed that farmers based their price on what they will generate from exporting the cotton. They want to sell at 40 cents per kilogramme of cotton.

“If we accede to the price, our output will become uncompetitive considering the infrastructural deficit in the country, which affects the cost of production. We are in a fix. Some factories have suspended production because they do not have cotton for production.

“In the past, there was a market board and government had control over the price of cotton. We want the government to intervene in this matter and save manufacturers. We have the machinery and the workforce and we are ready to produce, but we are hindered by the present situation.”

The Director-General of the Lagos Chamber of Commerce and Industry (LCCI), Muda Yusuf, decried the lack of a fiscal policy framework to guide operations in the real sector.

According to him, if the fundamentals are not right, backward integration will not work as so many linkages in the value-chain are missing.

“We need to build capacity of investors in the value-chain for backward integration to be successful. Except for the big manufacturers with huge capacity, it could be too much for industrialists to embark on the process with little or no support. Government needs to embark on a holistic and integrated approach as some of the raw materials are not easy to get as it is being described”, Yusuf said.

The Director-General of NTMA, Hamma Kwajaffa, also alleged that rivalry among government agencies contributed to the challenges hindering the growth of the textile industry.

“The former Minister of Agric initiated the creation of the cotton corporation, but he had a rivalry with the Minister of Trade that said establishing the corporation falls within his domain. That was how the whole matter was stalled at the Federal Executive Council.

“The absence of regulation makes everyone to fix prices that they want across the value chain. If you go to Chad, you cannot just buy cotton. It is regulated by their government. We will prefer that local usage of cotton is given preference before export,” Kwajaffa said.

The Chairman, MAN Gas Users Group, Dr. Michael Adebayo stated that dollarisation of materials needed for production is a disincentive for local producers, adding that the trend has affected gas pricing, with many operators struggling to keep their factories running.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago