- Opportunities in Oil Sector’ll be Over Soon

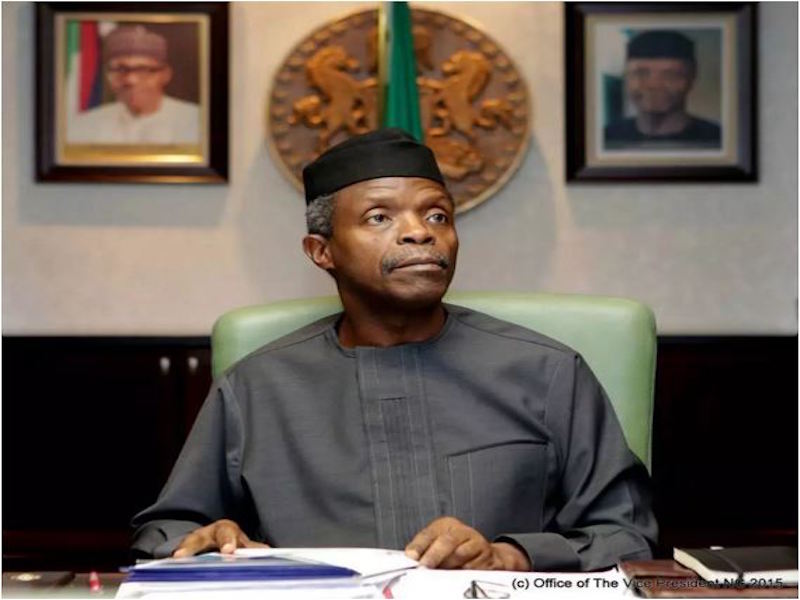

Vice President Yemi Osinbajo on Monday stated that opportunities in the petroleum industry were narrowing and might be over sooner than expected as a result of the increasing breakthroughs in renewable energy use as well as the expansion in the patronage of electric vehicles globally.

According to him, although Nigeria needs oil as it works towards diversifying its economy, the party may soon be over in the petroleum industry.

Speaking as a special guest at the presentation of three books written by the Minister of State for Petroleum Resources, Dr. Ibe Kachikwu, in Abuja, the vice president explained that it was becoming increasingly important for the country to diversify its economy.

Osinbajo said, “As we move to diversify our economy, we are particularly aware that we need oil to get out of oil, yet our window of opportunity to benefit maximally from the petroleum industry is narrowing.

“The development of shale oil, which the author spent considerable time on, the increasing breakthroughs in renewable energy use, the speed of expansion in the use of electric vehicles –Japan now has more electric charging stations than gas stations – all point to the fact that the party may be over sooner than we expected.”

He stated that the minister had delivered what could be described as probably the most significant contributions to help understand the country’s petroleum sector.

Osinbajo said, “You will not find the insights that Kachikwu offers in the chapters on marketing and transportation of petroleum products, divestment, negative trend in the Nigerian petroleum industry and ministerial discretion in any textbook or policy manual on the subject.

“Kachikwu clearly took full advantage of the mere convergence of scholarship, contemporary experience and policy wisdom to deliver what are probably today the most significant contributions to our understanding of the major issues of the Nigerian petroleum industry.”

The three books unveiled at the event were ‘Compendium of Oil and Gas Cases in Nigeria’, ‘Legal Issues in the Nigerian Petroleum Industry’, and ‘The Petroleum Industry Bill: Getting to the Yes’.

Kachikwu told journalists that although the contents of the books were his professional and privileged thoughts, it would be helpful if the federal and state governments, the National Assembly and stakeholders in the industry took the issues raised into consideration.

He said, “Obviously, we looked at the historical issues of the PIB as well as the current ones. A lot of what have been done were captured, and also a lot of those things that they’ve not done in the fiscal areas were captured too, because the fiscal area is key. But there is a lot of room for thoughts and the objective of getting to yes with the PIB is to get to yes.

“The book on the PIB looked at what are the challenging issues that have stopped the bill from being passed, what is the politics in it, and also stepping away from the politics, it looked at the core critical areas that are essential if we want to succeed in it. So, there’s going to be a lot of room for dialogue with the National Assembly.

“What I’ve provided are my thoughts and are guiding thoughts, which I think can help in moving the industry forward. I wrote as a Nigerian privileged to have some of the information and access to data that I have and I think that a lot of the things I say, if taken into consideration by the government, will help solve a lot of problems.”

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago