Nigeria has opened talks with China for the financing and construction of two new communication satellites at a cost of $701m.

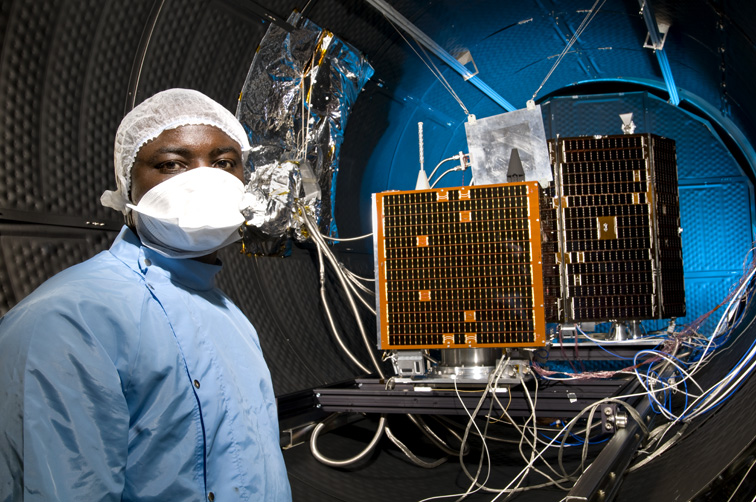

The new satellites, to be known as NigComSat-2 and NigComSat-3, are to serve as backup to the country’s existing communications satellite, NigComSat-1R, which was put in the orbit in December 2011.

The General Manager, Satellite Applications, Nigerian Communications Satellite Limited, Mr. Abdulrahman Adelajah, disclosed these at a media parley hosted by the company in Abuja on Wednesday.

He also said that NigComSat had won a bid to provide In-Orbit Test for Belarus for the launching of its new satellite from the company’s Abuja ground station.

Adelajah said the China EXIM Bank would finance the construction of the new satellites, which would likely be handled by the China Great Wall Industry Corporation.

He stated, “Following the successful launch of NigComSat-1R, two additional satellites, NigComSat-2 and NigComSat-3, are required to provide backup services, expand operations and boost customer confidence.

“The Federal Government has already commenced budgetary provision in this respect. In furtherance of the sustained commercial relations between the Federal Republic of Nigeria and the People’s Republic of China, the Ministry of Finance has been negotiating with the China EXIM Bank to provide a loan facility to support a series of Nigerian developmental projects, including the manufacture and launch of NigComSat-2 and 3 at a cost of $701m.”

He added, “Both NigComSat-2 and NigComSat-3 satellites are designed to operate in a geostationary orbit and delivered to orbit locations of 19 degrees East and 22 degrees West, respectively for provision of C-Band, Ku-Band and Ka-Band payload capability for a minimum service life of 15 years.

“NigcomSat-2 is designed to cover Nigeria, Middle East, China and other Asian countries, whilst NigComSat-3 will cover Nigeria, and the South and North America. With the three satellites in orbit, it will be possible for the Nigerian telecommunications industry to dominate the African market within a period of five years after the launch of the satellites.”

Nigeria’s first communications satellite, NigComSat-1, was designed and built by the CGWIC at a cost of $400m. The satellite, which was put in the orbit in May 2007, was deorbited in November 2008 following the development of a power fault. It was replaced in December 2011 with NigComSat-1R by the same company.

In a statement made available to our correspondent, the Head of Public Affairs, NigComSat, Mr. Adamu Idris, explained that the company had been announced as the winner of a bid to provide In-Orbit Test and Carrier Spectrum Services for the Belintersat-1 satellite owned by Belarus.

The Belarus satellite, also constructed by the CGWIC, is set for launch in January 2016.

Forex2 weeks ago

Forex2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira2 weeks ago

Naira2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira1 week ago

Naira1 week ago