A Delta Air Lines flight from Atlanta to Lagos was diverted to Togo following the midair death of a yet-to-be-identified passenger. The unfortunate incident occurred approximately...

Amidst a backdrop of global economic shifts and geopolitical recalibration, gold prices dipped below the $2,300 price level. The decline comes as investors carefully analyse signals...

Despite ongoing tensions in the Middle East, oil prices remained resilient, holding steady above key levels on Tuesday. Brent crude oil traded above $87 a barrel...

Health insurance is a crucial aspect of financial planning and ensuring access to quality healthcare. However, sometimes life gets busy, and you may forget to renew...

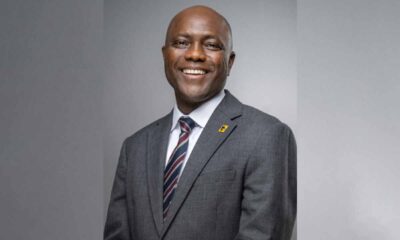

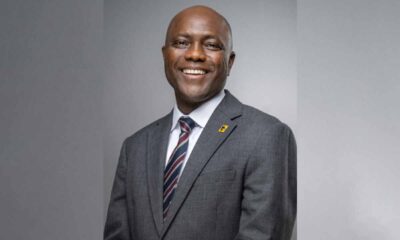

First Bank of Nigeria Limited, a subsidiary of FBN Holdings PLC, has announced the appointment of Mr. Olusegun Alebiosu as its Acting Chief Executive Officer (CEO)....

Nigerian Breweries Plc, the largest brewery in Nigeria, has announced plans to N600 billion through a rights issue, with the primary objective of clearing its N500...

The Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, has accused the former executives of the Nigerian Content Development and Monitoring Board (NCDMB) of mismanaging...

Transcorp Hotels is gearing up to launch a massive 5,000-capacity event centre and further its ambitious expansion plans both across Nigeria and Africa. Dupe Olusola, the...

The Securities and Exchange Commission (SEC) has successfully brought about N2.36 trillion in discretionary and non-discretionary funds under custody. This achievement follows the implementation of updated...

In a significant move toward a greener and more sustainable future for Nigeria’s transportation sector, the Presidency has announced plans to launch approximately 2,700 Compressed Natural...