Nigerian Breweries Plc, the largest brewery in Nigeria, has announced plans to N600 billion through a rights issue, with the primary objective of clearing its N500...

The Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, has accused the former executives of the Nigerian Content Development and Monitoring Board (NCDMB) of mismanaging...

Transcorp Hotels is gearing up to launch a massive 5,000-capacity event centre and further its ambitious expansion plans both across Nigeria and Africa. Dupe Olusola, the...

The Securities and Exchange Commission (SEC) has successfully brought about N2.36 trillion in discretionary and non-discretionary funds under custody. This achievement follows the implementation of updated...

In a significant move toward a greener and more sustainable future for Nigeria’s transportation sector, the Presidency has announced plans to launch approximately 2,700 Compressed Natural...

The Independent Petroleum Marketers Association of Nigeria (IPMAN) is looking forward to another significant drop in the price of diesel, with expectations set on a target...

Amidst escalating tensions between Iran and Israel, the global oil markets find itself in a precarious position, with traders and investors anxiously watching for potential ramifications...

UBA America, the United States subsidiary of United Bank for Africa (UBA) Plc hosted diplomats, government officials and business leaders to a networking reception in partnership with the...

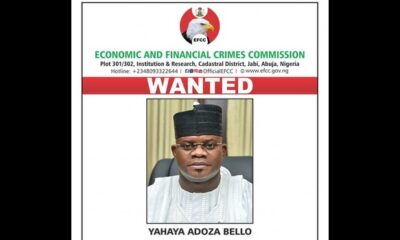

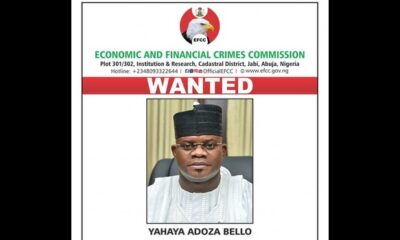

The Economic and Financial Crimes Commission (EFCC) has escalated its pursuit of justice by declaring former Kogi State Governor, Yahaya Bello, wanted over alleged money laundering...

Ecobank Transnational Incorporated (ETI) has announced the successful repayment of its $500 million Eurobond. The Eurobond, issued in April 2019 with a coupon rate of 9.5%,...