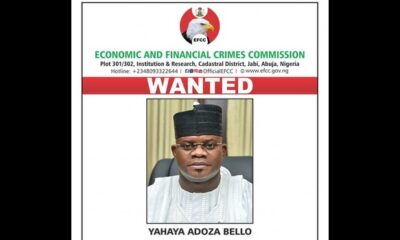

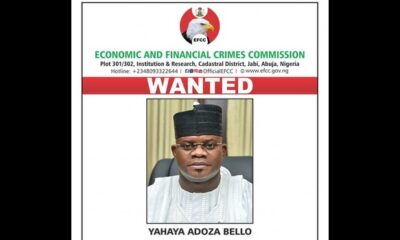

The Economic and Financial Crimes Commission (EFCC) has escalated its pursuit of justice by declaring former Kogi State Governor, Yahaya Bello, wanted over alleged money laundering...

Gold, often viewed as a haven during times of geopolitical uncertainty, exhibited a characteristic surge in response to reports of Israel’s alleged strikes in Iran, only...

Cocoa futures in New York have reached a historic pinnacle with the most-active contract hitting an all-time high of $11,578 a metric ton in early trading...

In response to the recent banking recapitalization exercise announced by the Central Bank of Nigeria (CBN), the Securities and Exchange Commission (SEC) has reiterated its commitment...

The Dangote Petroleum Refinery is capitalizing on the availability of cheaper oil imports from the United States. Recent reports indicate that the refinery with a capacity...

As geopolitical tensions between Israel and Iran escalate, investors are seeking refuge in traditional safe-haven assets, particularly bonds, while crude oil prices surge on fears of...

ARISE News Channel, a prominent Nigerian cable news network, has reached another significant milestone in its journey to become a global media powerhouse. The channel has...

The Nigerian Ports Authority (NPA) has successfully secured a $700 million loan from Citibank to facilitate the rehabilitation of the Lagos ports. The finance was facilitated...

Amid mounting tension and grievances over alleged mass layoffs, the National Union of Banks, Insurance and Financial Institutions Employees (NUBIFIE) has led its members to the...

Google has terminated 28 employees who participated in protests against the tech giant’s involvement in Project Nimbus, a joint venture with Amazon to provide AI and...