Nigerian Exchange Limited

Transcorp Gains 314.03% Last Week Despite NGX Closing the Red

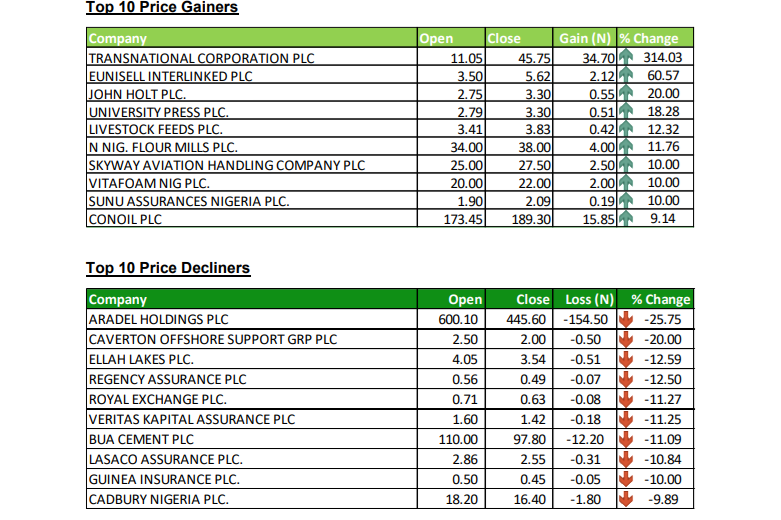

Transnational Corporation Plc (Transcorp), Nigeria’s largest listed conglomerate, gained N34.70 or 313.03% a share last week to close at N45.75 a unit after the company’s unaudited financial statement for the third quarter showed 352% year-on-year growth in profit before tax to N34.566 billion.

During the week, investors on the floor of the Nigerian Exchange Limited (NGX) transacted 2.717 billion shares worth N54.632 billion in 46,848 deals, against a total of 2.142 billion shares valued at N85.946 billion that exchanged hands in 41,217 deals in the previous week.

The Financial Services Industry led the activity chart with a combined 1.821 billion shares valued at N28.958 billion traded in 20,173 deals, therefore, contributing 67.01% and 53.01% to the total equity turnover volume and value, respectively.

The ICT Industry followed with 389.848 million shares worth N6.560 billion in 2,515 deals. In third place was the Conglomerates Industry with a turnover of 160.993 million shares worth N4.746 billion in 3,623 deals.

Fidelity Bank Plc, Chams Holding Company Plc and United Bank for Africa Plc accounted for 1.225 billion shares worth N17.721 billion in 4,912 deals and contributed 45.10% and 32.44% to the total equity turnover volume and value, respectively.

The NGX All-Share index closed the week in the red at 97,432.02 index points, a 2.03% decline from 99,448.91 index points recorded in the previous week. The Exchange year-to-date return moderated to 30.30%.

Also, the market capitalization of listed equities dipped by the same 2.03% from N60.261 trillion to N59.039 trillion.

Similarly, all other indices finished lower with the exception of NGX Banking, NGX AFR Bank Value, NGX AFR Div Yield, NGX MERI Growth, NGX MERI Value, NGX Oil & Gas and NGX Growth which appreciated by 0.19%, 1.76%, 1.52%, 0.16%, 0.48%, 1.15%, and 0.07% respectively while the NGX ASeM index closed flat.

Thirty-nine equities appreciated in price during the week lower than fifty-eight equities in the previous week. Forty-five equities depreciated in price higher than eighteen in the previous week, while sixty-eight equities remained unchanged, lower than seventy-six recorded in the previous week.