Nigerian Exchange Limited

Nigerian Exchange Extends Bullish Run as Investors Gain N2.123 Trillion Last Week

The Nigerian Exchange Limited (NGX) extended its bullish run last week as investors gained N2.123 trillion following a N3.258 trillion profit reported in the previous week.

During the week, investors exchanged 1.773 billion shares worth N52.867 billion in 44,713 deals, against a total of 2.157 billion shares valued at N108.824 billion that exchanged hands in 51,556 deals in the previous week.

The Financial Services Industry led the activity chart with 1.136 billion shares valued at N23.185 billion traded in 19,896 deals. Therefore, contributing 64.04% and 43.86% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 339.390 million shares worth N5.874 billion in 3,650 deals.

The third place was the Consumer Goods Industry, with a turnover of 82.645 million shares worth

N6.724 billion in 6,155 deals.

Transnational Corporation Plc, Guaranty Trust Holding Company Plc and Access Holdings Plc were the three most traded equities and accounted for a combined 677.439 million shares worth N17.287 billion in 7,789 deals. The three equities contributed 38.21% and 32.70% to the total equity turnover volume and value respectively.

The NGX All-Share Index appreciated by 3.71% or 3,754.40 index points from 101,330.85 index points reported in the previous week to 105,085.25 index points last week.

The market capitalization rose by 3.71% to close the week at N59.416 trillion, up from N57.293 trillion filed in the previous week.

Similarly, all other indices finished higher with the exception of NGX Oil and Gas and NGX Sovereign Bond which depreciated by 0.11% and 3.12% respectively.

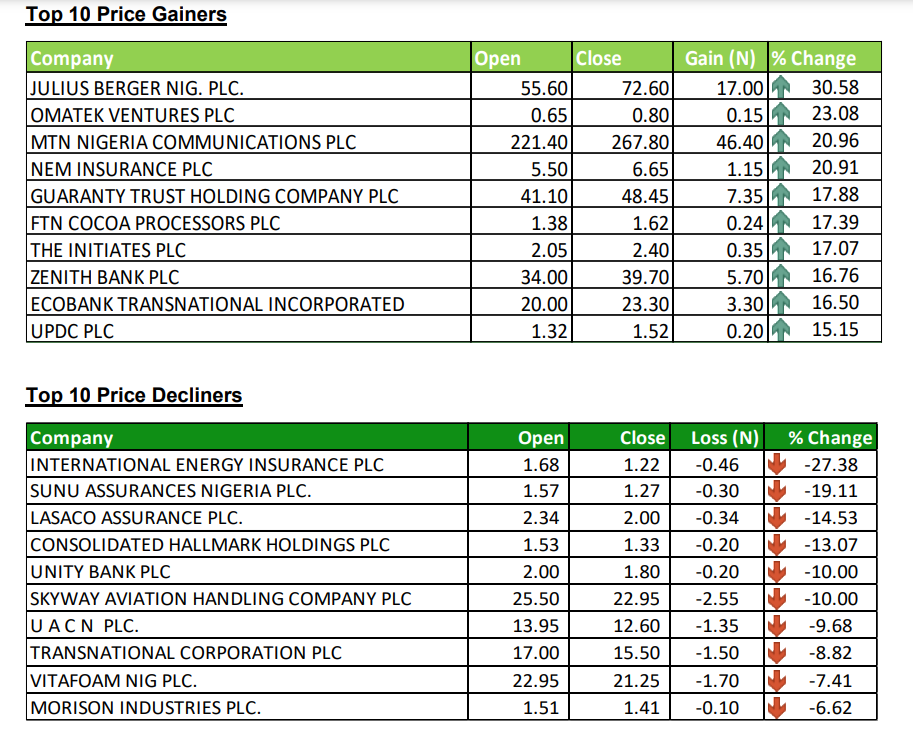

Fifty-five equities appreciated in price during the week higher than twenty-two equities in the previous week. Twenty-four equities depreciated in price lower than fifty-six in the previous week, while seventy-five equities remained unchanged, lower than seventy-six recorded in the previous week.