Nigerian Exchange Limited

Nigerian Stock Sheds N1.826 Trillion Last Week

The Nigerian Exchange Limited (NGX) continued its bearish trend last week as investors lost another N1.826 trillion following the N1.989 trillion loss recorded in the previous week.

During the week investors transacted 1.882 billion shares worth N34.149 billion in 48,464 deals against a total of 1.377 billion shares valued at N31.584 billion that exchanged hands in 42,040 deals in the previous week.

The Financial Services Industry led the activity chart with 1.275 billion shares valued at N20.427 billion traded in 24,801 deals. Therefore, contributed 67.78% and 59.82% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 227.237 million shares worth N2.972 billion in 3,351 deals.

The third place was the Oil and Gas Industry, with a turnover of 115.327 million shares worth N746.959 million in 2,704 deals.

Transnational Corporation Plc, United Bank for Africa Plc and Access Holdings Plc were the three most traded equities during the week under review. The three accounted for 563.139 million shares worth N10.155 billion in 9,270 deals and contributed 29.93% and 29.74 to the total equity turnover volume and value, respectively.

The NGX All-Share Index lost 3.27% or 3,336.32 index points from 102,088.30 index points recorded in the previous week to 98,751.98 index points last week while the market capitalization depreciated by 3.27% to close the week at N54.035 trillion, down from N55.861 trillion.

Similarly, all other indices finished lower with the exception of NGX ASem, NGX AFR Bank Value and NGX Sovereign Bond which appreciated by 16.93%, 1.15%, and 8.25%, respectively.

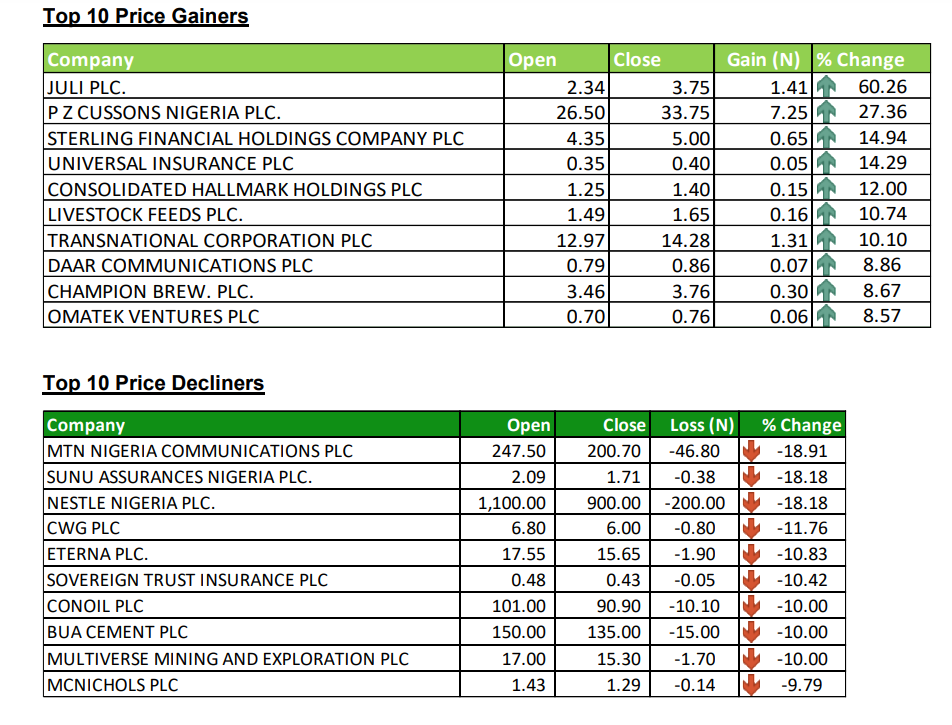

Twenty-seven equities appreciated in price during the week higher than fourteen equities in the previous week. Fifty-four equities depreciated in price lower than sixtysix in the previous week, while seventy-two equities remained unchanged, lower than seventy-four recorded in the previous week.