Nigerian Exchange Limited

Investors Lose N1.989 Trillion Last Week as Uncertainty Persists

The Nigerian Exchange Limited (NGX) closed in the red last week as uncertainty continues to dictate market direction across the Exchange amid complex president Bola Ahmed Tinubu’s economic reform.

Stock investors exchanged 1.377 billion shares worth N31.584 billion in 42,040 deals last week, against a total of 1.559 billion shares valued at N36.497 billion that exchanged hands in 42,546 deals in the previous week.

During the week, the Financial Services Industry led the activity chart with 960.519 million shares valued at N16.844 billion traded in 19,669 deals. Therefore, contributing 69.77% and 53.33% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 115.241 million shares worth N1.511 billion in 2,859 deals.

The third place was the Oil and Gas Industry, with a turnover of 80.866 million shares worth N1.721

billion in 2,726 deals.

Guaranty Trust Holding Company Plc, FBN Holdings Plc and Transnational Corporation Plc were the three most traded equities and together accounted for 343.584 million shares worth N9.431 billion in 5,659 deals.

The three contributed a combined 24.96% and 29.86% to the total equity turnover volume and value respectively.

The NGX All-Share Index depreciated by 3,634.48 index points or 3.44 percent from 105,722.78 index points to 102,088.30 index points while the market capitalization also shed 3.44% or N1.989 trillion to close the week at N55.861 trillion, down from N57.850 trillion recorded in the previous week.

Similarly, all other indices finished lower with the exception of NGX ASem, NGX Consumer Goods and NGX Oil and Gas which appreciated by 11.66%, 2.01% and 0.01% respectively.

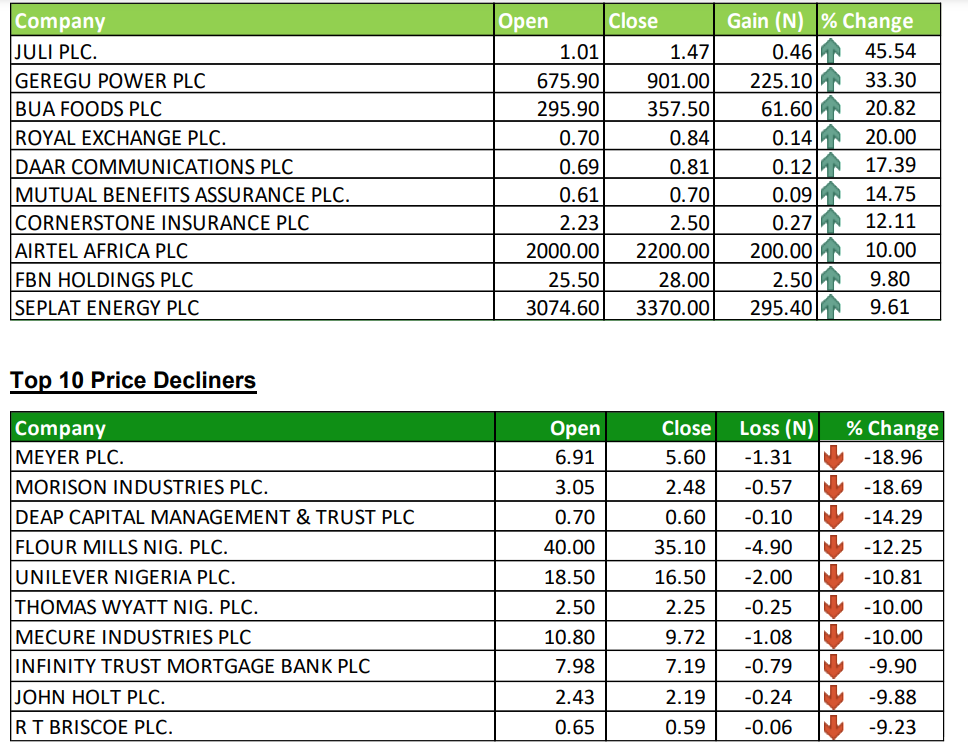

Fourteen equities appreciated in price during the week lower than thirty-five equities in the previous week. Sixty-six equities depreciated in price higher than fiftyone in the previous week, while seventy-four equities remained unchanged, higher than sixty-eight recorded in the previous week.

Top 10 Price Gainers