Nigerian Exchange Limited

Nigerian Stock Market Rebounds Last Week as Investors Pocketed N2.115 Trillion

The Nigerian stock market known as the Nigerian Exchange Limited (NGX) closed higher last week with investors gaining N2.115 trillion, a rebound from the previous week when the Exchange closed in the red.

During the week, investors transacted 1.559 billion shares worth N36.497 billion in 42,546 deals, against a total of 2.478 billion shares valued at N47.856 billion that exchanged hands in 54,982 deals in the previous week.

The Financial Services Industry led the activity chart with 1.127 billion shares valued at N18.908 billion that were traded in 19,424 deals. Therefore, contributing 72.27% and 51.81% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 117.400 million shares worth N1.508 billion in 2,775 deals.

The third place was Consumer Goods with a turnover of 98.422 million shares worth N4.008

billion in 6,322 deals.

United Bank for Africa Plc, FBN Holdings Plc and Guaranty Trust Holding Company Plc were the three most traded equities during the week under review. The three accounted for a combined 389.286 million shares worth N11.757 billion that exchanged hands in 5,372 deals and contributed 24.96% and 32.21% to the total equity turnover volume and value respectively.

The NGX All-Share Index appreciated by 3.79% or 3,864.41 index points from 101,858.37 index points reported in the previous week to 105,722.78 index points last week.

Market Capitalization appreciated by 3.79% to close the week at N57.850 trillion, a N2.115 trillion increase from the N55.735 trillion it closed in the previous week.

The Exchange year-to-date return rose to 41.39%.

Similarly, all other indices finished higher with the exception of NGX CG, NGX Banking, NGX AFR Bank Value, NGX AFR Div Yield, NGX MERI Growth, NGX Industrial Goods, NGX Growth and NGX Sovereign Bond which depreciated by 0.18%, 1.34%, 3.32%, 0.32%, 3.43%, 1.83%, 6.50% and 0.02% respectively.

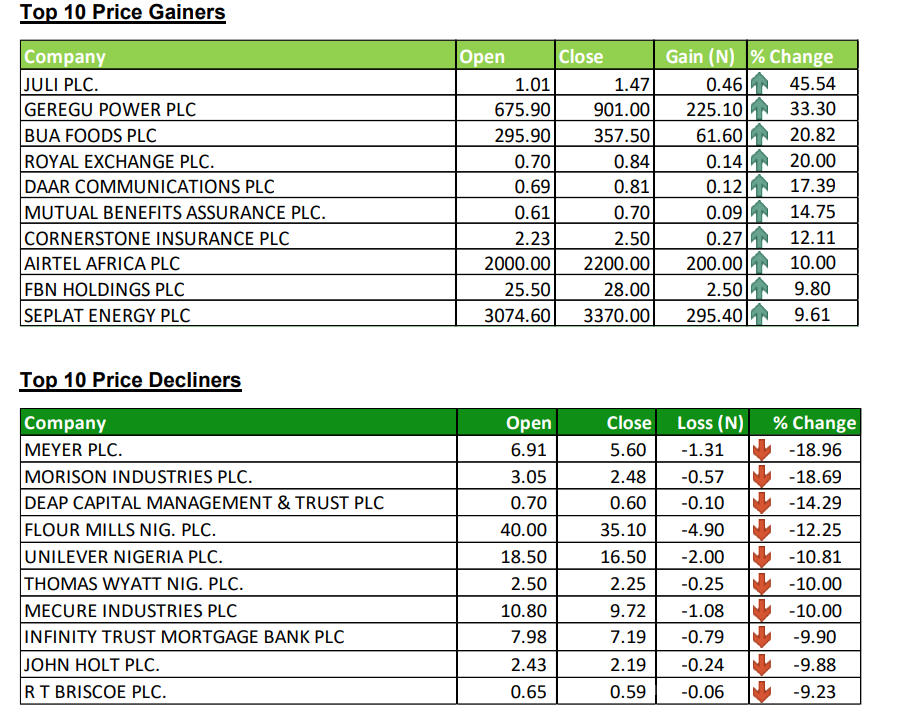

Thirty-five equities appreciated in price during the week higher than twenty equities in the previous week. Fifty-one equities depreciated in price lower than sixty-eight in the previous week, while sixty-eight equities remained unchanged, higher than sixty-six recorded in the previous week.