Nigerian Exchange Limited

Stock Investors Loses N1.423 Trillion Last Week as Exchange Extends Decline

The Nigerian Exchange Limited (NGX) extended its decline last week as investors lost N1.423 trillion amid rising selloffs.

During the week, stock investors transacted 2.478 billion shares worth N47.856 billion in 54,982 deals, against a total of 3.893 billion shares valued at N95.147 billion that exchanged hands in 69,117 deals in the previous week.

A further breakdown shows that the Financial Services Industry led the activity chart with 1.687 billion shares valued at N28.514 billion that were traded in 25,751 deals, therefore contributing 68.10% and 59.58% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 210.272 million shares worth N2.988 billion in 4,419 deals.

In third place was the Oil and Gas Industry, with a turnover of 203.777 million shares worth N2.139 billion in 4,544 deals.

FBN Holdings Plc, Transnational Corporation Plc and Jaiz Bank Plc were the most traded equities during the week under review. The three accounted for a combined 732.804 million shares worth N13.705 billion in 7,040 deals and contributed 29.57% and 28.64% to the total equity turnover volume and value respectively.

The NGX All-Share Index declined by -2,562.86 index points or 2.45% from 104,421.23 index points recorded in the previous week to 101,858.37 index points last week while the Market Capitalization depreciated by 2.49% to N55.735 trillion, down from N57.158 trillion posted in the previous week.

The year-to-date return moderated from 39.65% in the previous week to 36.22%.

Similarly, all other indices finished lower with the exception of NGX ASeM which appreciated by 4.63%.

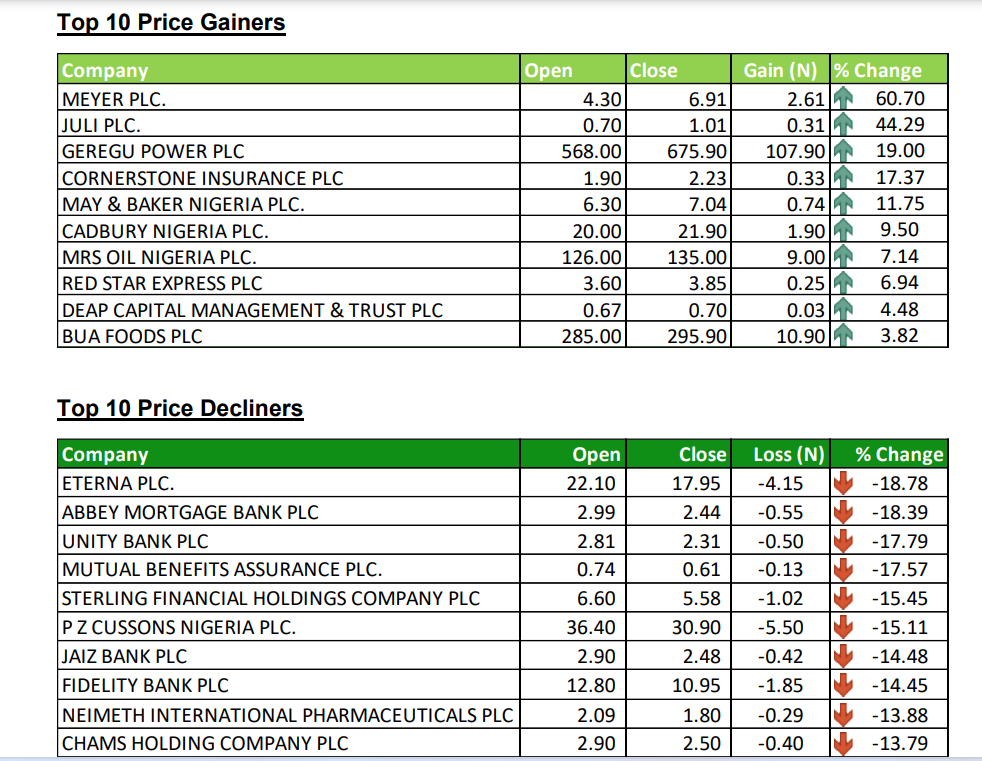

Twenty equities appreciated in price during the week lower than twenty-seven equities in the previous week. Sixty-eight equities depreciated in price higher than sixty-four in the previous week, while sixty-six equities remained unchanged, higher than sixty-four recorded in the previous week.