Nigerian Exchange Limited

Stock Investors Gain N1.848 Trillion Last Week Amid Record Growth

The Nigerian Exchange Limited (NGX) extended its bullish run last week as bank stocks sustained broad-based growth.

During the week, investors exchanged 5.719 billion shares worth N88.828 billion in 80,064 deals, against a total of 3.320 billion shares valued at N41.755 billion that exchanged hands in 46,994 deals in the previous week.

Breaking down key sectors, the Financial Services Industry led the activity chart with 3.873 billion shares valued at N53.364 billion traded in 39,913 deals. Therefore, it contributed 67.72% and 60.08% to the total equity turnover volume and value, respectively.

The Conglomerates Industry followed with 725.490 million shares worth N9.886 billion in 7,658 deals.

The third place was the Oil and Gas Industry, with a turnover of 223.240 million shares worth N2.690

billion in 4,464 deals.

Transnational Corporation Plc, FCMB Group Plc and Fidelity Bank Plc were the three most traded equities during the week. The three accounted for a combined 1.380 billion shares worth N17.741 billion in 12,442 deals, contributing 24.12% and 19.97% to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 4.24% or 3,378.30 index points to close the week at 83,042.96 index points, up from 79,664.66 index points reported in the previous week.

The market capitalisation gained 4.24% or N1.848 trillion from N43.594 trillion filed in the previous week to N45.442 trillion.

Similarly, all other indices finished higher with the exception of NGX Oil and Gas which depreciated by 1.61%, while the NGX ASeM index closed flat.

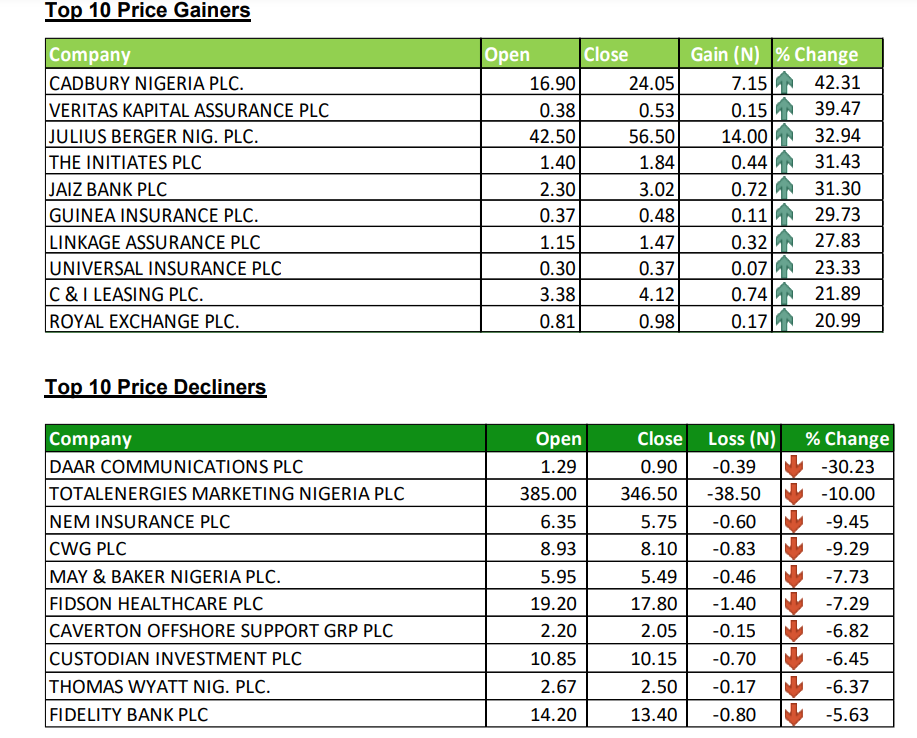

Seventy-five equities appreciated in price during the week lower than eighty-eight equities in the previous week. Twenty-three equities depreciated in price higher than seventeen in the previous week, while fifty-seven equities remained unchanged, higher than fifty recorded in the previous week.