Nigerian Exchange Limited

Stock Market Gains N183 Billion Last Week

The Nigerian stock exchange market extended its gain last week as investors pocketed N183 billion.

During the week, investors exchanged 2.025 billion shares worth N27.693 billion in 32,763 deals against a total of 2.525 billion shares valued at N45.297 billion that exchanged hands in 32,815 deals in the previous week.

Breaking down activities for the week, the Financial Services Industry led the activity chart with 1.202 billion shares valued at N11.481 billion traded in 12,775 deals, therefore contributing 59.38% and 41.46% to the total equity turnover volume and value, respectively.

The Oil and Gas Industry followed with 328.656 million shares worth N3.163 billion in 4,713 deals.

In third place was the Services Industry, with a turnover of 131.249 million shares worth N539.745 million in 2,263 deals.

Japual Gold and Venture Plc, Fidelity Bank Plc and Jaiz Bank Plc were the most traded equities during the week, accounting for a combined 488.181 million shares worth N1.967 billion that exchanged hands in 3,136 deals and contributed 24.11% and 7.10% to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 0.37% to close the week at 71,112.99 index points from 70,849.38 index points recorded in the previous week while the market capitalisation of all listed equities expanded by N183 billion to N39.108 trillion.

Similarly, all other indices finished higher with the exception of NGX Main Board, NGX Banking, NGX Industrial Goods and NGX Sovereign Bond which depreciated by 0.11%, 0.04%, 1.18% and 0.27% respectively while the NGX ASeM index closed flat.

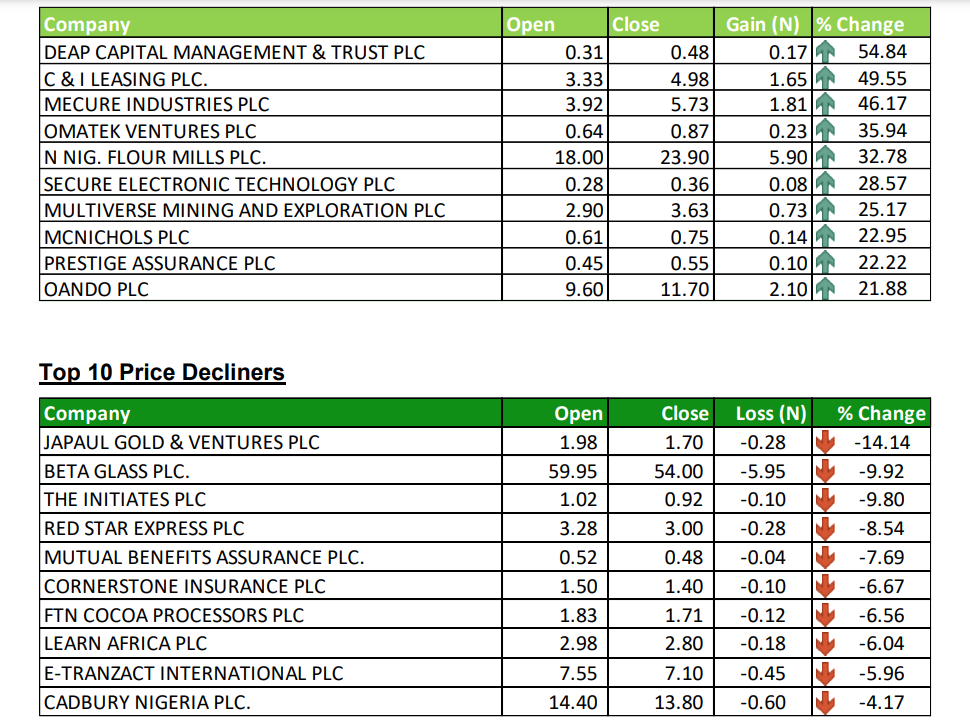

Fifty-four equities appreciated in price during the week higher than thirty-seven equities in the previous week. Thirty equities depreciated in lower than forty-three in the previous week, while seventy-two equities remained unchanged, lower than seventy-five recorded in the previous week.

Year to date, the Exchange has returned 38.75%. See the table below for the top 10 gainers and losers.