Nigerian Exchange Limited

Stock Investors Gained N92 Billion Last Week as The Exchange Extends Bullish Run

Investors in the Nigerian Exchange Limited (NGX) gained N92 billion last week as the bullish run continues across key sectors.

During the week, investors exchanged 1.741 billion shares worth N25.087 billion in 30,652 deals, against a total of 2.575 billion shares valued at N29.615 billion that exchanged hands in 37,713 deals in the previous week.

A breakdown of the market report showed the Financial Services Industry led the activity chart with 1.244 billion shares valued at N12.616 billion traded in 13,398 deals. Therefore, contributing 71.43% and 50.29% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 133.034 million shares worth N575.673 million in 1,572 deals.

The third place was the ICT Industry, with a turnover of 87.649 million shares worth N2.292 billion

in 2,404 deals.

Also read: Oil Prices Slip Over 1% Amidst China Recovery Worries and Stronger Dollar

Sterling Financial Holdings Company Plc, FBN Holdings Plc, and Universal Insurance Plc were the most traded stocks last week, accounting for a combined 518.847 million shares worth N3.917 billion in 1,901 deals and contributed 29.80% and 15.61% to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 0.20% to close the week at 65,325.37 index appoints, up from 65,198.08 index points, while the market capitalisation grew by 0.26% from N35.480 trillion achieved in the previous week to N35.572 trillion last week.

Similarly, all other indices finished higher with the exception of NGX Main Board, NGX AFR. Div. Yield, NGX MERI Growth, NGX Consumer Goods, NGX Oil & Gas, NGX Lotus II, and NGX Industrial Goods indices which depreciated by 0.10%, 1.60% 0.40%, 0.92%, 0.32%, 0.09%, and 0.39% respectively while the NGX ASeM index closed flat

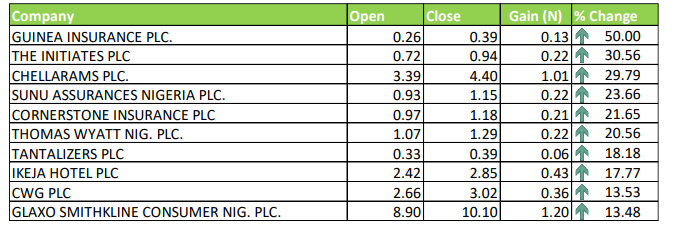

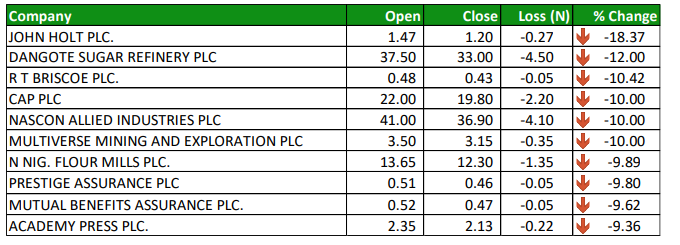

Forty-one equities appreciated in price during the week lower than forty-two equities in the previous week. Forty-four equities depreciated in price lower than fifty-two in the previous week, while seventy equities remained unchanged, higher than sixty-two recorded in the previous week.