Nigerian Exchange Limited

Nigerian Stock Market Sheds N281 Billion as Uncertainty Ahead of General Elections Heightened

The Nigerian stock market has taken a hit, with N281 billion lost last week

The Nigerian stock market has taken a hit, with N281 billion lost last week. The Nigerian Exchange Limited (NGX) suffered a decline from N29.591 trillion recorded in the previous week to N29.310 trillion last week. The decline can be attributed to the current economic uncertainty ahead of Nigeria’s general elections.

During the week, investors traded a total of 751.990 million shares worth N20.575 billion in 15,822 deals, compared to a total of 944.293 million shares valued at N22.710 billion that exchanged hands in 18,615 deals in the previous week. The financial services industry led the activity chart with 508.517 million shares valued at N6.212 billion traded in 6,877 deals.

The Consumer Goods Industry followed with 86.346 million shares worth N4.806 billion in 2,562 deals, and in third place was the Industrial Goods Industry, with a turnover of 34.305 million shares worth N3.635 billion in 1,305 deals. The top three most traded equities in the week were Guaranty Trust Holding Company Plc, United Bank for Africa Plc, and FBN Holdings Plc.

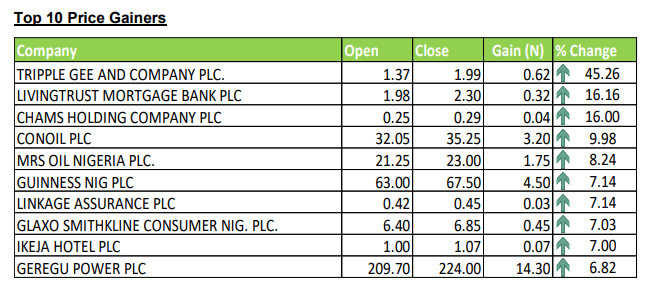

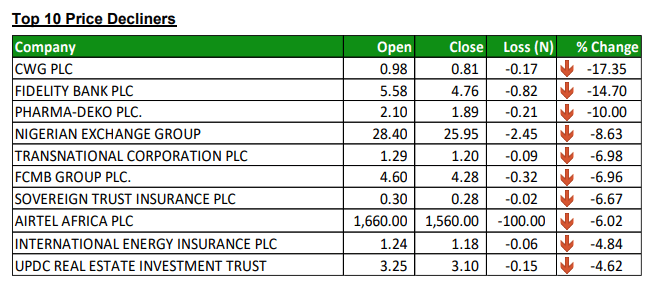

The NGX All-Share Index also depreciated by 0.96% from 54,327.30 index points achieved in the previous week to 53,804.46 index points last week. Market capitalization depreciated by 0.95% to close at N29.310 trillion. The year-to-date return moderated to 4.98%, see the details of top gainers and losers below.

In addition, all other indices finished lower except NGX Premium, NGX Insurance, NGX MERI Growth, NGX Consumer Goods, NGX Oil and Gas, NGX Industrial Goods, and NGX Growth indices, which appreciated. The NGX ASeM and NGX Sovereign Bond indices, however, remained flat.

The uncertainty surrounding the upcoming elections is the primary reason for the stock market’s setback. This has resulted in investors taking a cautious approach and holding back on making significant investments. The decline in the stock market is likely to continue until there is more clarity on the outcome of the elections.