Nigerian Exchange Limited

Stock Investors Gained N703 Billion Last Week

Investors in the Nigerian stock market gained an additional N703 billion last week to take its year-to-date return to 2.46%.

During the week, activity at the exchange was higher as stock investors transacted 1.286 billion shares worth N29.634 billion in 19,816 deals, against a total of 921.856 million shares valued at N27.154 billion that exchanged hands in 15,601 deals in the previous week.

The financial services industry led the activity chart with 952.237 million shares valued at N9.728 billion traded in 9,647 deals. Therefore, it contributed 74.07% and 32.83% to the total equity turnover volume and value, respectively.

The industrial goods industry followed with 92.864 million shares worth N8.510 billion exchanged in 1,682 deals. In third place was the conglomerates industry, with a turnover of 54.568 million shares worth N96.654 million in 754 deals.

FBN Holdings Plc, Sterling Bank Plc, and Guaranty Trust Holding Company Plc were the three most traded equities during the week. Three accounted for a combined 507.852 million shares worth N5.707 billion that exchanged hands in 2,585 deals and contributed 39.50% and 19.26% to the total equity turnover volume and value, respectively.

The Nigerian Exchange Limited (NGX) All-Share Index appreciated by 2.52% or 1,290.14 index points from 51,222.34 index points recorded in the previous week to 52,512.48 index points last week.

Market capitalization also gained 2.52% to close the week at N28.602 trillion, representing an increase of N703 billion.

Similarly, all other indices finished higher with the exception of NGX Insurance and NGX Growth indices which depreciated by 1.64% and 4.40% respectively, while the NGX ASeM and NGX Sovereign Bond indices closed flat.

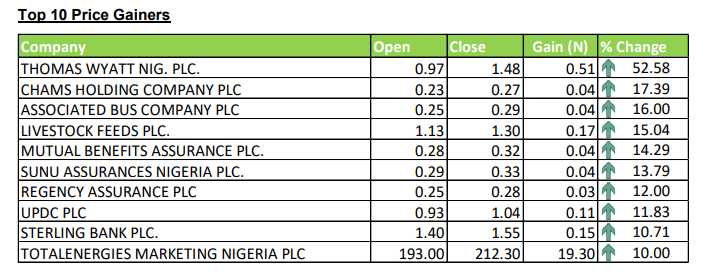

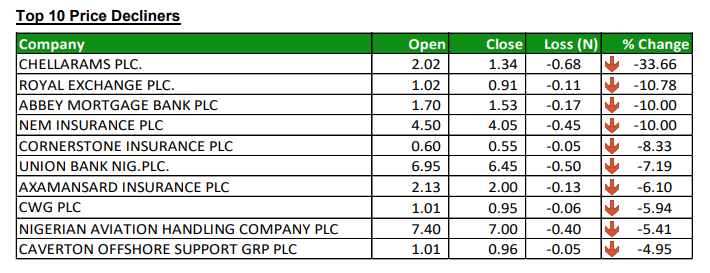

Fifty-one equities appreciated in price during the week, higher than thirty-eight equities in the previous week. Twenty-seven equities depreciated in price higher than seventeen in the previous week, while seventy-nine equities remained unchanged, lower than one hundred and two equities recorded in the previous week.