Nigerian Exchange Limited

Nigerian Stock Market Closes First Week in the Red

The Nigerian stock market closed the very first week of the year in the red despite closing 2022 with a 19.98% profit, Investors King reports.

In the four trading days’ week, activity on the Nigerian Exchange Limited (NGX) was mixed as stock investors transacted a total turnover of 921.856 million shares worth N27.154 billion in 15,601 deals, against a total of 1.880 billion shares valued at N18.988 billion that exchanged hands in 12,036 deals in the last week of 2022.

A sectorial analysis of the week’s activity showed that the financial services industry led the activity table with 616.527 million shares valued at N6.452 billion that were traded in 7,208 transactions. Therefore, the industry contributed 66.88% and 3.76% to the total equity turnover volume and value, respectively.

This was followed by the industry goods industry with 138.314 million shares worth N13.356 billion that were traded in 1,063 deals during the week. In third place was the conglomerates industry, with a turnover of 55.931 million shares worth N92.845 million in 502 deals.

FBN Holdings Plc, BUA Cement Plc and Guaranty Trust Holding Company Plc were the three most traded equities during the week. The three accounted for a combined 450.338 million shares worth N17.203 billion that were traded in 1,862 deals and contributed 48.85% and 63.35% to the total equity turnover volume and value respectively.

The NGX All-Share Index depreciated by 0.06% or 28.72 index points from 51,251.06 index points it closed in the last week of 2022 to 51,222.34 index points. Market capitalization also declined by 0.06% to N27.899 trillion.

All other indices finished higher with the exception of NGX Main Board, NGX Industrial Goods and NGX Sovereign Bond indices which depreciated by 0.54%, 0.58% and 0.09% respectively, while the NGX ASeM index closed flat.

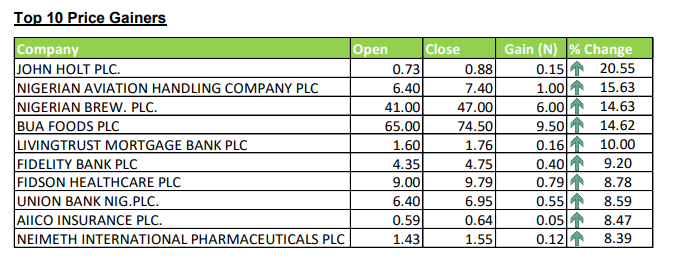

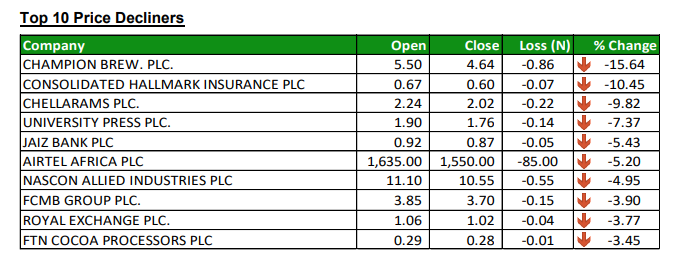

Thirty-eight equities appreciated in price during the week, lower than forty-four equities in the previous week. Seventeen equities depreciated in price higher than sixteen in the previous week, while one hundred and two equities remained unchanged, higher than ninety-seven equities recorded in the previous week. See the details of top gainers and losers below.