Nigerian Exchange Limited

Nigeria’s Stock Market Extends Gain Last Week as Investors Gain N236 Billion

Investors traded a total of 814.089 million shares worth N12.204 billion in 15,488 deals, in contrast to a total of 1.225 billion shares valued at N15.243 billion that exchanged hands in 15,317 deals in the previous week.

The Nigerian Exchange Limited (NGX) extended its gain last week as investors pocketed N235 billion despite activity declining ahead of the Christmas holiday.

During the week, investors traded a total of 814.089 million shares worth N12.204 billion in 15,488 deals, in contrast to a total of 1.225 billion shares valued at N15.243 billion that exchanged hands in 15,317 deals in the previous week.

Sectorial performance shows the Financial Services Industry led the activity chart with 663.799 million shares valued at N5.517 billion traded in 7,240 deals. Therefore, contributed 81.54% and 45.21% to the total equity turnover volume and value, respectively.

The ICT Industry followed with 44.358 million shares worth N4.493 billion in 1,136 deals. In third place was the

Consumer Goods Industry, with a turnover of 27.372 million shares worth N1.187 billion in 3,051 deals.

Sterling Bank Plc, Access Holdings Plc and Guaranty Trust Holding Company Plc were the three most traded equities last week. The three accounted for a combined 394.878 million shares worth N2.847 billion exchanged in 2,274 deals and contributed 48.51% and 23.33% to the total equity turnover volume and value, respectively.

Market value of all listed equities appreciated by 0.89% or N236 billion to close the week at N26.861 trillion, up from N26.625 trillion recorded in the previous week.

The NGX All-Share Index also rose by 0.89% or 434.36 index points to close the week at 49,316.29 index points from 49,316.29 index points. The year-to-date return improved to 15.45%.

Similarly, all other indices finished higher with the exception of NGX Consumer Goods, NGX Growth and NGX Sovereign Bond indices which depreciated by 0.20%, 0.52% and 0.44%, respectively

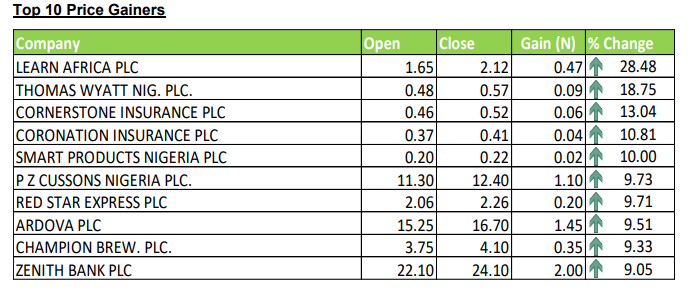

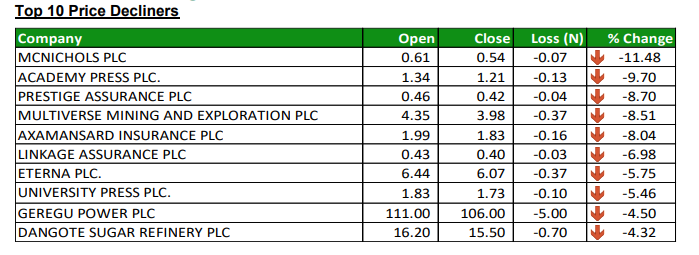

Thirty-two equities appreciated in price during the week, higher than thirty-one equities in the previous week. Twenty-eight equities depreciated in price higher than twenty-six in the previous week, while nineth-seven equities remained unchanged, lower than one hundred equities recorded in the previous week.