Nigerian Exchange Limited

Nigerian Stock Market Extends Gain to 14.43% Year to Date

The Nigerian Exchange Limited (NGX) has rebounded from its bearish trend with investors pocketing N396 billion last week.

Despite shedding most of its first half of the year gains in October due to interest rates increase, the Nigerian Exchange Limited (NGX) has rebounded from its bearish trend with investors pocketing N396 billion last week.

During the week, investors exchanged 1.225 billion shares worth N15.243 billion in 15,317 deals, against a total of 839.978 million shares valued at N12.418 billion that exchanged hands in 16,183 deals in the previous week.

The Financial Services Industry led the activity chart with 514.067 million shares valued at N5.104 billion that exchanged hands in 6,489 deals. Therefore, it contributed 41.97% and 33.48% to the total equity turnover volume and value, respectively.

The Construction/Real Estate Industry followed with 463.348 million shares worth N1.620 billion in 210 deals. In third place was the Conglomerates Industry, with a turnover of 69.017 million shares worth

N86.431 million in 528 deals.

UPDC Real Estate Investment Trust, FBN Holdings Plc and Transnational Corporation Plc were the three most traded equities during the week. The three accounted for a combined 765.230 million shares worth N4.282 billion in 847 deals and contributed 62.47% and 28.09% to the total equity turnover volume and value, respectively.

The NGX All-share index appreciated by 1.51% or 727.28 index points from the 48,154.65 index points it closed in the previous week to 48,881.93 index points last week. The market capitalisation gained N396 billion last week to settle at N26.625 trillion.

This year-to-date gain improved to 14.43%, up from 3.93%, Investors King reports.

Similarly, all other indices finished higher with the exception of NGX CG, NGX Premium, NGX Banking, NGX Pension, NGX AFR Bank Value, NGX AFR Div Yield, NGX MERI Growth, NGX MERI Value and NGX Sovereign Bond indices which depreciated by 0.91%, 1.23%, 0.25%, 0.39%, 1.53%, 0.79%, 0.79%, 0.21% and 0.01% respectively, while the NGX Growth and NGX ASeM indices closed flat.

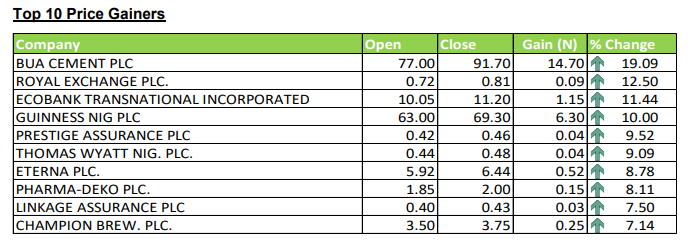

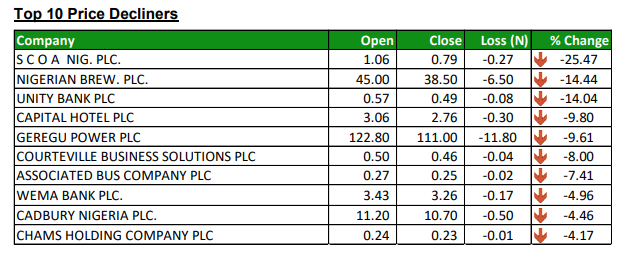

Thirty-one equities appreciated in price during the week, lower than thirty-seven equities in the previous week. Twenty-six equities depreciated in price higher than twenty-five in the previous week, while one hundred equities remained unchanged, higher than ninety-five equities recorded in the previous week. See the details of top gainers and losers below.