Nigerian Exchange Limited

Unity Bank Posts 36% Gain as NGX Closes in Red Last Week

Investors traded 1.101 billion shares worth N11.714 billion in 15,697 deals, in contrast to a total of 1.410 billion shares valued at N15.510 billion that exchanged hands in 19,025 deals in the previous week.

The Nigerian Exchange Limited (NGX) extended its fourth-quarter decline to 10.31% last week as the uncertainty surrounding the naira redesign deepened.

During the week, investors traded 1.101 billion shares worth N11.714 billion in 15,697 deals, in contrast to a total of 1.410 billion shares valued at N15.510 billion that exchanged hands in 19,025 deals in the previous week.

The Financial Services Industry led the activity chart with 859.019 million shares valued at N6.691 billion traded in 8,157 deals. Therefore, contributing 78% and 57.12% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 96.989 million shares worth N109.622 million in 425 deals. In third place was the Oil & Gas Industry, with a turnover of 40.897 million shares worth N367.117 million in 1,065 deals.

Access Holdings Plc, Sterling Bank Plc and Transnational Corporation Plc were the three most traded equities during the week. The three accounted for a combined 577.512 million shares worth N2.761 billion that exchanged hands in 1,132 deals and contributed 52.44% and 23.57% to the total equity turnover volume and value, respectively.

The NGX All-Share Index depreciated by 0.68% from 44,269.18 index points recorded in the previous week to 43,968.75 index points last week. The market value declined by N163 billion to N23.949 trillion, down from the N24.112 trillion it closed in the previous week.

Similarly, all other indices finished lower with the exception of NGX Banking, NGX-AFR Bank Value, NGX AFR Div. Yield and NGX MERI Value, which appreciated by 0.17%, 0.38%, 1.10% and 0.20% respectively, while the NGX ASeM, NGX Growth and NGX Sovereign Bond indices closed flat.

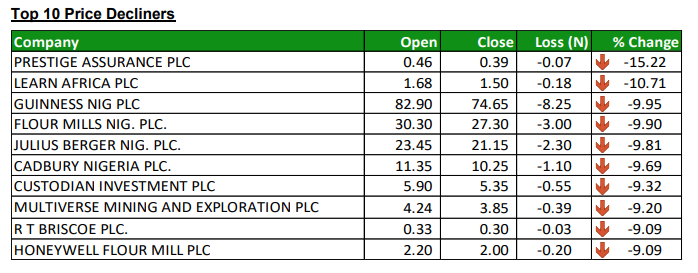

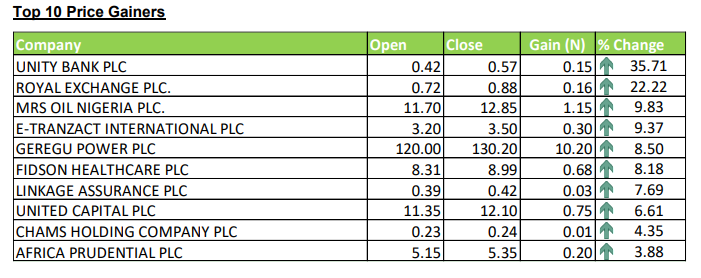

Twenty-seven equities appreciated in price during the week, higher than twenty equities in the previous week. Thirty-six equities depreciated in price lower than fortythree in the previous week, while ninety-four equities remained unchanged, same as ninety-four equities recorded in the previous week.

The Exchange year to date moderated to 2.93%.