Finance

Nigerian Stock Investors Lose N660 Billion Last Week

Weak economic fundamentals ahead of the 2023 presidential elections continue to dictate the direction of the Nigerian stock market as investors lost another N660 billion last week.

Weak economic fundamentals ahead of the 2023 presidential elections continue to dictate the direction of the Nigerian stock market as investors lost another N660 billion last week.

In the four trading days’ week, due to 62nd independence holiday, investors transacted 586.939 million shares worth N8.837 billion in 17,183 deals, against a total of 1.005 billion shares valued at N10.406 billion that exchanged hands in 17,844 deals in the previous week.

Analysing each sector, the Financial Services Industry led the activity chart with 393.814 million shares valued at N4.660 billion traded in 9,168 deals. Therefore, contributed 67.1% and 52.73% to the total equity turnover volume and value, respectively.

The ICT Industry followed with 48.178 million shares worth N1.203 billion in 1,294 deals. In third place was the Conglomerates Industry, with a turnover of 40.135 million shares worth N44.406 million in 513 deals.

Guaranty Trust Holding Company Plc, Sterling Bank Plc and Zenith Bank Plc. were the three most traded equities during the week. The three accounted for 239.637 million shares worth N3.546 billion that exchanged hands in 4,375 deals and contributed a combined 40.83% and 40.13% to the total equity turnover volume and value, respectively.

The NGX All-Share Index depreciated by 3.41% or 1,672.73 index points to close the week at 47,351.43 index points, down from 49,026.62 index points reported in the previous week.

Market capitalization of all listed equities dipped by 2.50% or N660 billion from N26.451 trillion in the previous week to close N25.791 trillion last week.

Similarly, all other indices finished lower with the exception of the NGX ASeM, NGX Growth and NGX Sovereign Bond indices which closed flat.

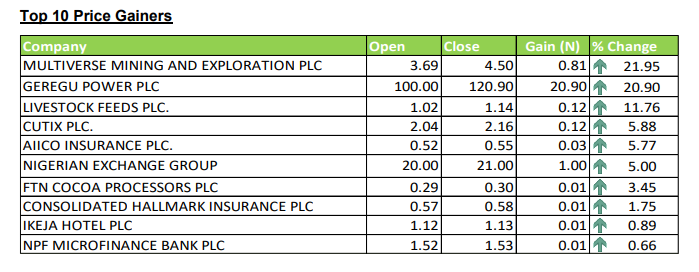

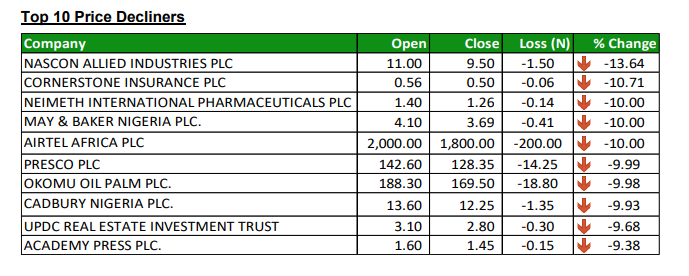

Eleven equities appreciated in price during the week, lower than twenty-five equities in the previous week. Forty-six equities depreciated in price higher than thirtythree in the previous week, while one hundred equities remained unchanged higher than ninety-eight equities recorded in the previous week.

The Year to date return declined to 10.85% while the Exchange has shed 3.41% this month and quarter. See top gainers and losers below.