Nigerian Exchange Limited

Nigerian Stock Market Depreciates Marginally Last Week

The Nigerian Exchange Limited (NGX) depreciated slightly last week as economic uncertainty ahead of the 2023 general elections continues to dictate market directions.

The Nigerian Exchange Limited (NGX) depreciated slightly last week as economic uncertainty ahead of the 2023 general elections continues to dictate market directions.

A total of 1.005 billion shares worth N10.406 billion were exchanged in 17,844 deals during the week, against a total of 562.856 million shares valued at N9.438 billion that exchanged hands in 16,013 deals in the previous week.

Breaking down each of the key sectors, the Financial Services Industry led the activity chart with 757.289 million shares valued at N6.947 billion traded in 9,483 deals. Therefore, contributing 75.38% and 66.76% to the total equity turnover volume and value respectively. The Conglomerates Industry followed with 75.118 million shares worth N82.955 million in 494 deals.

In third place was the Consumer Goods Industry, with a turnover of 50.186 million shares worth N1.457 billion in 2,798 deals.

Jaiz Bank Plc, Guaranty Trust Holding Company Plc, and Zenith Bank Plc. were the three most traded equities during the week. The three accounted for 460.216 million shares worth N4.963 billion in 4,281 deals and contributed 45.81% and 47.69% to the total equity turnover volume and value respectively.

The market value of listed equities appreciated by 0.03 percent to N26.451 trillion last week, while the NGX All-Share Index declined by 0.01% to close the week at 49,024.16 index points.

Similarly, all other indices finished lower with the exception of NGX Main-Board, NGX 30, NGX Oil & Gas and NGX Industrial Goods, which appreciated by 0.25%, 0.04%, 0.20%, and 3.01% while The NGX ASeM, NGX Growth and NGX Sovereign Bond indices closed flat.

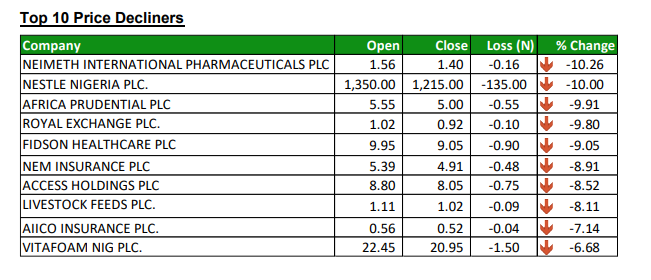

Twenty-five equities appreciated in price during the week, higher than Seventeen equities in the previous week. Thirty-three equities depreciated in price lower than Forty-two in the previous week, while ninety-eight equities remained unchanged higher than ninety-seven equities recorded in the previous week.