Nigerian Exchange Limited

Stock Investors Lose N241 Billion Last Week

Investors in the Nigerian Exchange Limited (NGX) lost N241 billion last week as market uncertainty continues across the length and breadth of the market.

Investors in the Nigerian Exchange Limited (NGX) lost N241 billion last week as market uncertainty continues across the length and breadth of the market.

Investors transacted 562.856 million shares worth N9.438 billion in 16,013 deals during the week, against a total of 719.398 million shares valued at N8.004 billion that exchanged hands in 17,444 deals in the previous week.

Breaking down each sector’s performance, the financial services industry led the activity chart with 381.958 million shares valued at N4.551 billion traded in 8,627 deals. Therefore, contributed 67.86% and 48.21% to the total equity turnover volume and value, respectively.

The ICT industry followed with 59.345 million shares worth N2.480 billion in 1,272 deals. In third place was the services industry, with a turnover of 32.212 million shares worth N95.807 million in 607 deals.

Zenith Bank Plc, NGX Group Plc and Guaranty Trust Holding Company Plc were the three most traded equities during the week. The three accounted for 183.929 million shares worth N3.499 billion in 3,628 deals and contributed a combined 32.68% and 37.07% to the total equity turnover volume and value, respectively.

The NGX All-Share index declined by 0.91% or 448.80 index points to 49,026.62 index points, down from 49,475.42 index points recorded in the previous week.

Market capitalization depreciated by N241 billion from N26.686 trillion recorded in the previous week to N26.445 trillion last week.

Similarly, all other indices finished lower with the exception of NGX Premium, NGX Banking, NGX Pension, NGX AFR Bank Value and NGX MERI Value which appreciated by 0.13%, 2.27%, 0.05%, 0.08% and 1.84% while The NGX ASeM, NGX Growth and NGX SOVBND indices closed flat.

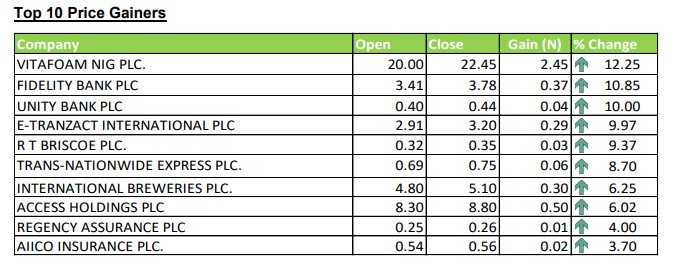

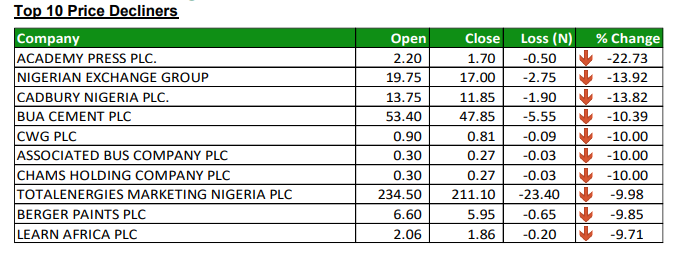

Seventeen equities appreciated in price during the week, higher than thirteen equities in the previous week. Forty-two equities depreciated in price higher than Thirty-nine in the previous week, while ninety-seven equities remained unchanged lower than one-hundred and four equities recorded in the previous week.

The year-to-date return moderated to 14.77%. See the details of top gainers and losers below.