Fintech

Nigerian Digital Bank Fairmoney Partners With Oradian to Accelerate Growth

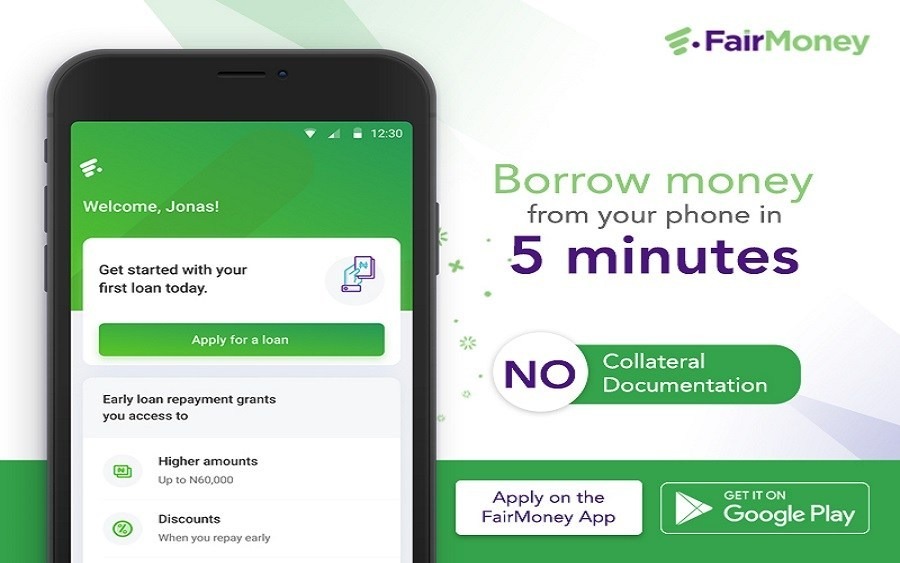

Nigerian online loan app Fairmoney has partnered with Oradian a cloud-based enterprise solution to expand its growth across Africa and Asia

Nigerian online loan app Fairmoney has partnered with Oradian a cloud-based enterprise solution to expand its growth across Africa and Asia.

Through this strategic partnership, Fairmoney will leverage on Oradian platform that services over 10 million banking customers in 13 countries across Africa and Asia to accelerate its growth in these regions.

FairMoney says Oradian’s ability to support its credit assessment capabilities and the ‘plug and play’ nature of its solution were key factors in its selection.

Speaking on this partnership, FairMoney CEO Laurin Hainy said: “Our ultimate goal remains bridging the financial inclusion gap in emerging economies, and we understand the power of collaboration and partnerships in bringing this to reality.

“Since the inception of FairMoney, we have continued to serve our current markets with excellent financial products, providing the much-needed access to credit and making essential banking services available to everyday people.

“We decided to partner with Oradian to leverage the already existing infrastructure and trusted system performance to scale our solutions to new markets where they are needed and perfect existing offerings in our current markets”.

Also commenting on this is the CEO of Oradian Antonio Separovic who said, “To be able to innovate quickly, with products that the market requires, while being compliant with changing regulations in very different markets, takes a different breed of core system.

“All of these are real daily challenges in the back-office, not seen by the customers and often taken for granted. However, we know through working with a broad range of financial customers, those challenges are very real, and in some cases, insurmountable without the right technology and an expert partner.”

The African and Asian emerging markets are in need of financial services that provide both consumer loans and working capital.

This has however created a big opportunity for companies that are able to move quickly and leverage recent technological advances in emerging markets.

FairMoney has been successful in executing this mission, after it became the leading credit-led digital financial institution in Nigeria two years after its incorporation.