Nigerian Exchange Limited

Activity on Stock Market Declined Last Week Amid Weak Economic Fundamental

Nigeria’s stock market extended its decline last week as more economic data points to growing uncertainty amid slowing productivity.

Nigeria’s stock market extended its decline last week as more economic data points to growing uncertainty amid slowing productivity.

In the month of July, the National Bureau of Statistics (NBS) report showed that Nigeria’s inflation rate rose to 19.64%, the highest in 17 years.

This was after the Central Bank of Nigeria’s lead monetary policy committee raised the interest rate to 14%, an increase of 250 basis points in the last two months. The apex bank increased borrowing costs to curtail escalating inflation numbers, and simultaneously, lure foreign investors to the Nigerian economy to boost capital importation and augment Nigeria’s dwindling foreign reserves.

All these changes in economic fundamentals impacted investments in the capital market, one of the key economic indicators of the Nigerian economy, and the economy at large.

Last week, stock investors transacted 823.005 million shares worth N12.228 billion in 17,482 deals, in contrast to a total of 1.511 billion shares valued at N13.547 billion that exchanged hands in 20,074 deals in the previous week.

During the week, the Financial Services Industry led the activity chart with 561.683 million shares valued at N5.576 billion traded in 8,388 deals. Therefore, contributing 68.25% and 45.60% to the total equity turnover volume and value respectively.

The ICT Industry followed with 91.819 million shares worth N1.478 billion in 1,532 deals. In third place was the Consumer Goods Industry, with a turnover of 42.546 million shares worth N3.396 billion in 2,639 deals.

FBN Holdings Plc, E-Tranzact International Plc and United Bank for Africa Plc were the three most traded equities last week and together accounted for 323.474 million shares worth N2.520 billion that were exchanged hands in 1,457 deals. The three contributed 39.30% and 20.61% to the total equity turnover volume and value respectively.

The NGX All-Share Index declined by 0.59% or 293.45 index points to close at 49,370.62 index points from 49,664.07 index points it settled in the previous week.

The Market capitalization depreciated by N158 billion to N26.629 trillion, down from N26.787 trillion it closed in the previous week.

Similarly, all other indices finished lower with the exception of The NGX Premium, NGX Banking, NGX-AFR Bank Value and NGX Industrial Goods Indices which appreciated by 0.12%, 0.65%, 0.07 and 0.28% while, The NGX ASeM and Growth indices closed flat.

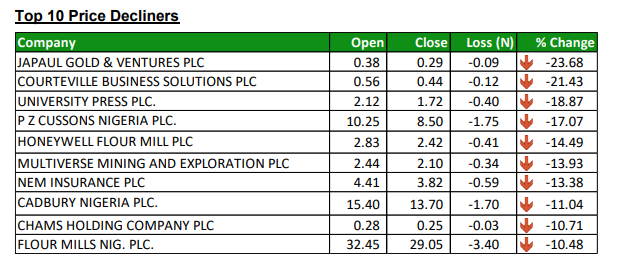

Twenty- one equities appreciated in price during the week, lower than Thirty- three equities in the previous week. Forty- one equities depreciated in price higher than Twenty- six in the previous week, while ninety-four equities remained unchanged lower than ninety-seven equities recorded in the previous week.

The Exchange year-to-date return declined further to 15.58%. See the details of top gainers and losers below.