Stock Market

Stock Investors Lose N571 Billion Last Week

Investors traded 1.511 billion shares worth N13.547 billion in 20,074 deals last week

Investors in the Nigerian stock market lost N571 billion last week as investors continue to close their positions amid growing economic uncertainty and high borrowing cost.

Investors traded 1.511 billion shares worth N13.547 billion in 20,074 deals last week, against a total of 705.636 million shares valued at N12.850 billion that exchanged hands in 22,124 deals in the previous week.

Analysing activity across key sectors, the Financial Services Industry led the activity chart with 680.202 million shares valued at N4.672 billion traded in 9,230 deals. Therefore, contributing 45.02% and 34.48% to the total equity turnover volume and value, respectively.

The Services Industry followed with 499.178 million shares worth N3.407 billion in 866 deals. In third place was

the ICT Industry, with a turnover of 113.804 million shares worth N2.246 billion in 2,083 deals.

Capital Hotel Plc, FBN Holdings Plc and Jaiz Bank Plc were the three most traded equities. Together, the three accounted for 763.836 million shares worth N5.130 billion that were traded in 1,025 deals and contributed 50.55% and 37.87% to the total equity turnover volume and value, respectively.

The NGX All-Share Index depreciated by 1,058.26 index points or 2.09% to 49,664.07 index points from 50,722.33 index points it closed in the previous week.

Market capitalization depreciated by 2.09% or N571 billion to N26.787 trillion last week, down from N27.358 trillion it settled in the previous week.

Similarly, all other indices finished lower with the exception of The NGX Insurance, NGX Consumer Goods and NGX Growth Indices which appreciated by 6.00%, 3.00% and 1.56% while, The NGX ASeM index closed flat.

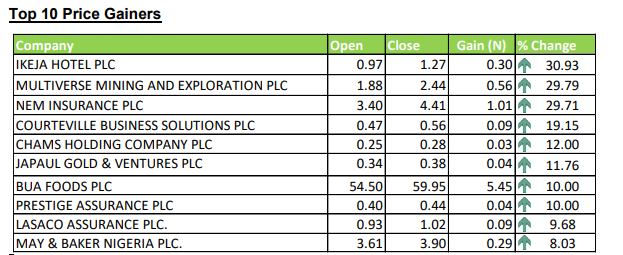

Thirty-three equities appreciated in price during the week, lower than forty-one equities in the previous week. Twenty- six equities depreciated in price higher than Twenty-two in the previous week, while ninety-seven equities remained unchanged higher than ninety-three equities recorded in the previous week.

The Exchange year-to-date return declined to 16.26%. See the details of top gainers and losers below.