Nigerian Exchange Limited

Stock Investors Pockets N195 Billion Last Week

Nigeria’s stock investors gained N195 billion last week despite the drop in activity level at the Nigerian Exchange Limited (NGX).

Nigeria’s stock investors gained N195 billion last week despite the drop in activity level at the Nigerian Exchange Limited (NGX).

Investors traded 705.636 million shares worth N12.850 billion in 22,124 deals during the week under review, in contrast to a total of 1.546 billion shares valued at N16.289 billion that exchanged hands in 23,873 deals in the previous week.

Breaking down key sectors, the Financial Services Industry led the activity chart with 442.525 million shares valued at N4.345 billion traded in 9,995 deals. Therefore, contributing 62.71% and 33.81% to the total equity turnover volume and value, respectively.

The Consumer Goods Industry followed with 82.126 million shares worth N2.176 billion in 3,875 deals. In third place was the Conglomerates Industry, with a turnover of 51.083 million shares worth N242.084 million in 694 deals.

Guaranty Trust Holding Company Plc, Zenith Bank Plc and FBN Holdings Plc were the three most traded equities last week. The three accounted for a combined 173.852 million shares worth N3.073 billion that were traded in 4,324 deals during the week. The three contributed 24.64% and 23.91% to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 0.70%, or 352.08 index points from 50,370.25 index points it closed in the previous week to 50,722.33 index points last week.

The market capitalisation gained N195 billion to N27.358 trillion last week, up from N27.358 trillion it settled in the previous week.

Similarly, all other indices finished higher with the exception of The NGX-Main Board, NGX NGX Insurance, NGX Industrial Goods and NGX Sovereign Bond Indices which depreciated by 1.16%, 0.37%, 5.76% and 0.07% while, The NGX ASeM index closed flat.

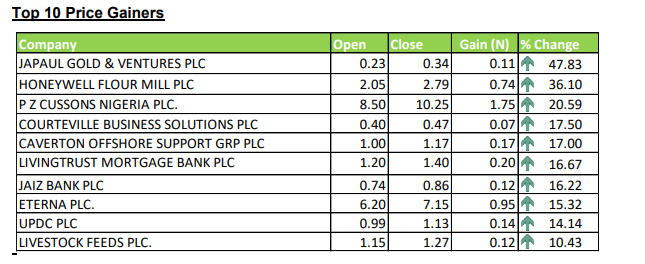

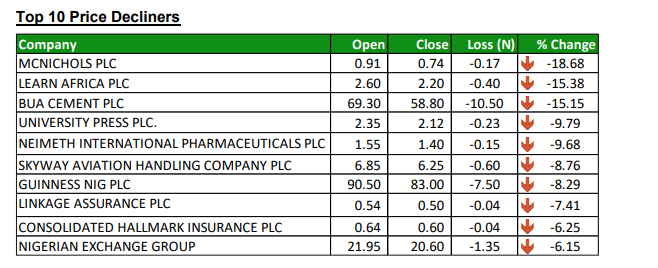

Forty- one equities appreciated in price during the week, higher than eleven in the previous week. Twenty-two equities depreciated in price lower than fifty-three in the previous week, while ninety three equities remained unchanged higher than ninety-two equities recorded in the previous week.

The year-to-date gain tick slightly higher to 18.74%. See other details below.