Economy

CBN Raises Interest Rate by 100 Basis Points to 14%

The Central Bank of Nigeria (CBN) on Tuesday raised the interest rate by another 100 basis points from 13% to 14% to curb the nation’s rising inflation rate and improve capital inflow.

The Central Bank of Nigeria (CBN) on Tuesday raised the interest rate by another 100 basis points from 13% to 14% to curb the nation’s rising inflation rate and improve capital inflow.

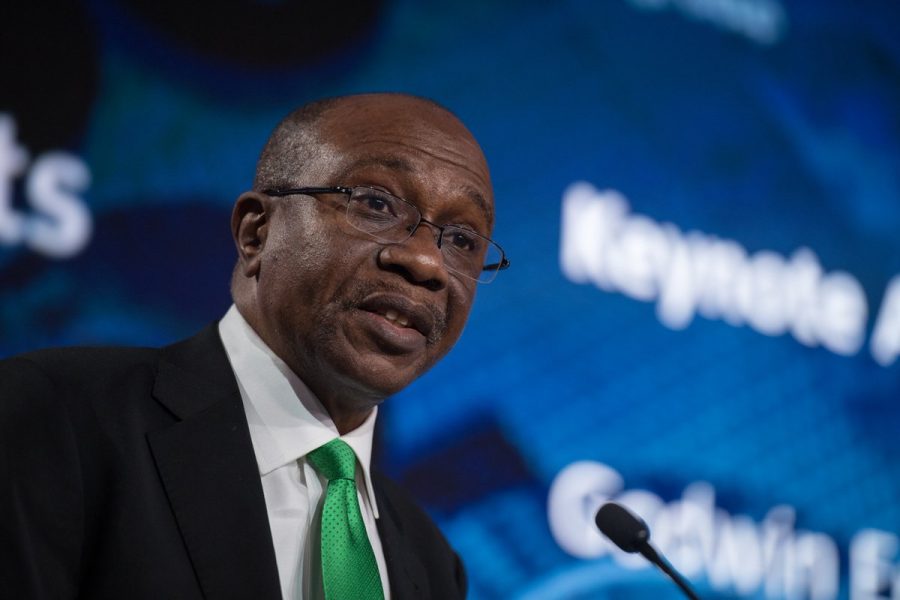

Godwin Emefiele, the Governor of the CBN, disclosed this on Tuesday after the 286th meeting of the Monetary Policy Committee held in Lagos.

He said the nine-member committee agreed that raising borrowing costs in an economy plagued with poverty, low new investments and weak new job creation is the right thing to do.

Emefiele said, “The committee resolved that the most rational policy option would be to further strengthen its tightening stance in order to effectively curtail the unabated rising trend of inflation.”

“Members were conscious of the fact that output growth remained fragile. However, not curtailing inflation now could erode the monetary gains achieved in improving consumer purchasing power and thus worsen the poverty level for the vulnerable populace.”

In May, the CBN raised the interest rate by 150 basis points to 13%, citing rising inflation rates and the need to curtail consumer prices to protect the nation’s monetary gains going forward. However, since the apex bank raised the interest rate in May, the inflation rate has been on the rise and presently at almost 19% in the month of June. Suggesting that rates increase has not been effective and also highlighted CBN’s other possible motive for aggressively raising rates in line with developed nations.

Presently, Nigeria has little to no fiscal space to wriggle out of possible recession given the size of its debt and revenue generation. Therefore, it needs constant capital inflow to sustain its dollar-dependent economy of 200 million people.

However, rising interest rates in developed economies make Nigerian assets unattractive to foreign investors currently being offered higher interest rates from the USA, to the U.K, Europe, Asia Pacific and so on. Hence, why the CBN is aggressively raising interest rates to sustain the dollar inflow and economic activity.

Nigeria’s foreign reserves stood at $39.441 billion as of July 19, 2022, despite rising oil prices. In the first four months of 2022, Africa’s largest economy spent N947.53 billion on fuel subsidy, and the World Bank estimated that Nigeria will lose N3 trillion in revenue in 2022 as a result of debt servicing.

“When we launched our previous Nigeria Development Update in November 2021, we estimated that Nigeria could stand to lose more than 3 trillion Naira in revenues in 2022 because the proceeds from crude oil sales, instead of going to the federation account, would be used to cover the rising cost of gasoline subsidies that mostly benefit the rich. Sadly, that projection turned out to be optimistic”, said Shubham Chaudhuri, World Bank Country Director for Nigeria.

Therefore, for Nigeria to continue to service its debt amid rising interest rates in developed economies, rising dollar strength and low oil production, Africa’s largest economy needs to lure foreign investors into the economy.