Nigerian Exchange Limited

Stock Investors Lose N139 Billion Last Week

The Nigerian stock market extended its decline last week as global uncertainties amid rising interest rates and weak earnings continue to dictate market trends.

The Nigerian stock market extended its decline last week as global uncertainties amid rising interest rates and weak earnings continue to dictate market trends.

Investors exchanged 822.404 million shares worth N10.366 billion in 20,643 deals last week, in contrast to a total of 1.348 billion shares valued at N24.487 billion that exchanged hands in 22,155 deals in the previous week.

The Financial Services Industry led the activity chart with 491.270 million shares valued at N 4.499 billion traded in 9,961 deals. Therefore, contributing 59.74% and 43.40% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 81.698 million shares worth N218.285 million in 605 deals. In third place was The Consumer Goods Industry, with a turnover of 55.052 million shares worth N855.318 million in 3,093 deals.

Guaranty Trust Holding Company Plc, United Bank for Africa Plc and Transnational Corporation Plc were the three most traded equities last week. The three accounted for a combined 244.025 million shares worth N2.680 billion that exchanged hands in 3,732 deals and contributed 29.67% and 25.86% to the total equity turnover volume and value respectively.

The market value of all listed equities declined by N139 billion from N27.942 trillion in the previous week to N27.803 trillion last week.

The Nigerian Exchange Limited (NGX) All-Share Index dipped by 0.53% from 51,829.67 index points it closed in the previous week to 51,557.41 index points last week.

Similarly, all other indices finished lower with the exception of the NGX AFR bank value Index which appreciated at 0.38%, while, the NGX ASeM and NGX Sovereign Bond Indices closed flat.

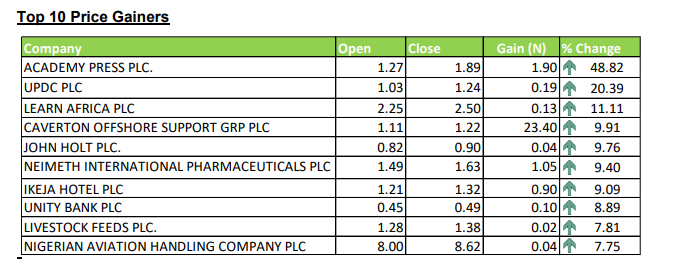

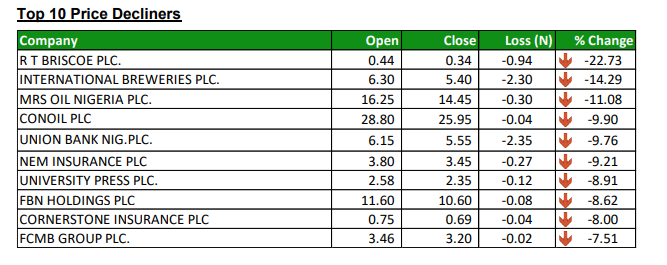

Thirty-one equities appreciated in price during the week, lower than Thirty-four in the previous week. Twenty-six equities depreciated in price lower than Twenty-nine in the previous week, while ninety-nine equities remained unchanged higher than ninety-three equities recorded in the previous week.

The Exchange year-to-date return declined to 20.70%, down from 21.33% in the previous week. See other details below.