Nigerian Exchange Limited

NGX All-Share Index Appreciates by 0.24%

The Nigerian equities market rebounded last week after weeks of a bearish trend to post a 0.24% gain.

The Nigerian equities market rebounded last week after weeks of a bearish trend to post a 0.24% gain.

Investors transacted 1.348 billion shares worth N24.487 billion in 22,155 deals during the week, against a total of 1.121 billion shares valued at N13.703 billion that exchanged hands in 22,350 transactions in the previous week.

The Financial Services Industry led the activity chart with 1.009 billion shares valued at N6.796 billion traded in 11,352 deals. Therefore, contributing 74.87% and 27.75% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 79,616 million shares worth N144.549 million in 689 deals. The third place was the oil and gas industry, with a turnover of 72.996 million shares worth N1.862

billion in 1,799 deals.

Mutual Benefits Assurance Plc, Living Trust Mortgage Bank Plc and Guaranty Trust Holding Company Plc were the three most traded equities during the week. The three accounted for a combined 484.839 million shares worth N2.414 billion that were transacted in 2,410 deals and contributed 35.97% and 9.86% to the total equity turnover volume and value respectively.

The Nigerian Exchange Limited (NGX) All-Share Index appreciated by 0.24% or 124.06 index points from 51,705.61 index points in the previous week to 51,829.67 index points last week.

The market value of listed equities grew to N27.942 trillion last week from N27.875 trillion recorded in the previous, representing an increase of N67 billion.

Similarly, all other indices finished higher with the exception of the NGX Afr bank value, NGX AFR Div Yield, NGX MERI Value , NGX Consumer Goods, NGX Oil/Gas and NGX Industrial Goods Indices which depreciated at 0.43%, 0.36%, 0.38%, 0.40%, 0.25% and 0.13% while, the NGX Sovereign Bond Index closed flat.

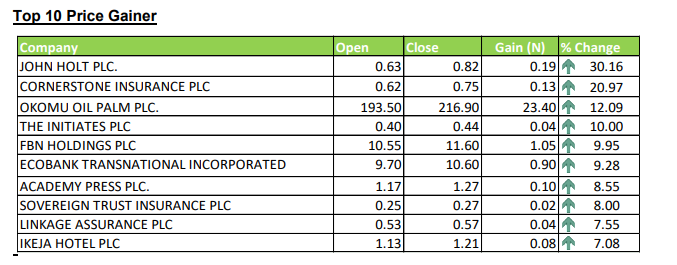

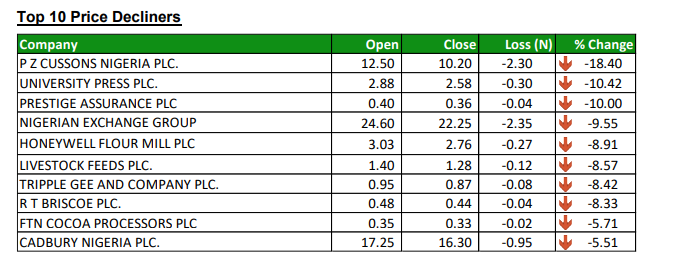

Thirty-four equities appreciated in price during the week, higher than Sixteen equities in the previous week. Twenty-nine equities depreciated in price lower than Fifty-six equities in the previous week, while ninety-three equities remained unchanged higher than eighty-four equities recorded in the previous week.

The year to date increased to 21.33%. See other details below.