Nigerian Exchange Limited

Nigerian Stock Market Extends Decline Last Week

The Nigerian Exchange Limited (NGX) extended its declines for a second consecutive week as market uncertainties amid projected global recession continue to dictate stocks’ direction.

The Nigerian Exchange Limited (NGX) extended its declines for a second consecutive week as market uncertainties amid projected global recession continue to dictate stocks’ direction.

Last week investors transacted 1.121 billion shares worth N13.703 billion in 22,350 deals, in contrast to a total of 940.892 million shares valued at N11.494 billion that exchanged hands in 20,077 deals in the previous week.

Breaking down the sectors, the Financial Services Industry led the activity chart with 806.824 Million shares valued at N6.075 billion that exchanged hands in 11,071 deals. Therefore, contributing 71.99% and 44.33% to the total equity turnover volume and value respectively.

The Oil and Gas Industry followed with 95.031 million shares worth N1.449 billion in 1,849 deals. In third place was the Conglomerates Goods Industry, with a turnover of 66.716 million shares worth N169.517 million in 733 deals.

FCMB Group Plc, United Bank for Africa Plc and Oando Plc were the three most traded equities during the week. The three accounted for a combined 407.770 million shares worth N2.009 billion in 2,181 deals. Therefore, contributing 36.39% and 14.66% to the total equity turnover volume and value respectively.

The NGX All-Share Index declined by 0.14% or 72.47 index points from 51,778.08 index points recorded in the previous week to 51,705.61 index points last week. The market value of listed equities depreciated by N39 billion to N27.875 trillion, down from N27.914 trillion. In the last two weeks, the Exchange has lost a combined N806 billion.

Similarly, all other indices finished lower with the exception of the NGX CG , NGX Premium NGX Banking, NGX Pension, NGX Afr bank value, NGX Oil/Gas and NGX Lotus indices which appreciated at 0.86%, 1.50%, 0.33%, 0.40%, 0.16%, 0.32% and 0.55% while, the NGX Asem and NGX Growth indices closed flat.

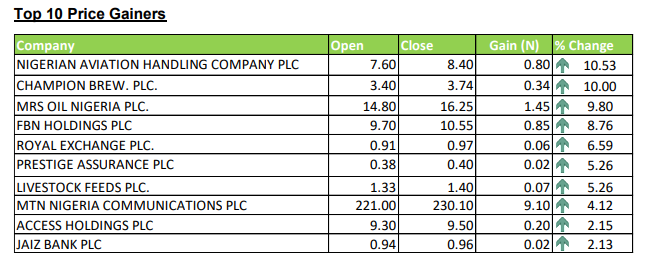

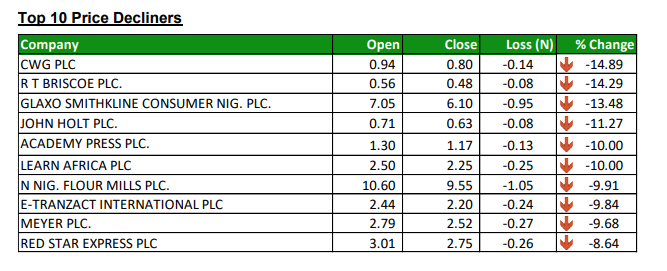

Sixteen equities appreciated in price during the week, higher than Thirteen equities in the previous week. Fifty-six equities depreciated in price higher than Fiftyone equities in the previous week, while eighty-four equities remained unchanged lower than ninety-two equities recorded in the previous week.

The Exchange year-to-date return moderated to 21.04%. See the week’s top gainers and losers below.