Nigerian Exchange Limited

Nigeria’s Stock Market appreciates by N158 Billion Last Week

Nigeria’s equities market appreciated last week despite the global market rout. The Nigerian Exchange Limited (NGX) gained N158 billion during the week as investors exchanged 1.831 billion shares worth N19.494 billion in 21,723 deals.

The shares and value traded were lower than 28.736 billion shares valued at N209.060 billion that exchanged hands in 23,688 deals in the previous week when Titan Bank purchased 27 billion shares in Union Bank.

During the week, the Financial Services Industry led the activity chart with 1.173 billion shares valued at N12.485 billion but traded in 10,657 deals. Therefore, the financial services industry contributed 64.07% and 64.04% to the total equity turnover volume and value, respectively.

The Conglomerates Industry followed with 419.100 million shares worth N607.703 million in 1,095 deals. In

third place was the Consumer Goods Industry, with a turnover of 69.680 million shares worth N2.754 billion in 3,158 deals.

FBN Holdings Plc, Transnational Corporation Plc and United Bank for Africa Plc were the three most traded equities and accounted for a combined 1.136 billion shares worth N8.323 billion in 2,906 deals. Therefore, the three contributed 62.08% and 42.70% to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 0.55% or 293.14 index points to close the week at 53,201.38 while the market value of all the listed equities grew by N159 billion to N28.681 trillion.

All other indices finished lower with the exception of the NGX 30, NGX CG, NGX Premium, NGX MERI Value, NGX Oil/Gas, NGX Lotus II and NGX Industrial Goods index which appreciated at 0.84%, 0.01%, 1.42%,0.32%, 0.68%, 1.62% and 0.25% while, the NGX Asem index closed flat.

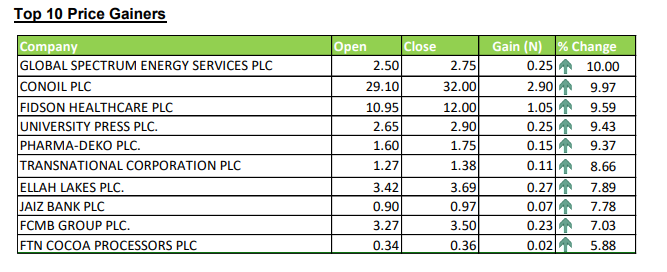

Twenty-nine equities appreciated in price during the week, lower than Thirty-six equities in the previous week. Thirty-six equities depreciated in price, lower than forty five equities in the previous week, while ninety-one equities remained unchanged higher than seventy-five equities recorded in the previous week.