Nigerian Exchange Limited

Nigeria’s Stock Investors Lose N635 Billion Last Week

Investors in Nigeria’s equities market lost N635 billion last week as the Nigerian Exchange Limited (NGX) resumes its bearish trend after posting a N596 billion gain in the previous week.

During the week, investors exchanged 28.736 billion shares worth N209.060 billion in 23,688 deals, against a total of 1.840 billion shares valued at N27.286 billion that exchanged hands in 27,273 deals in the previous week.

Breaking down key sectors, the Financial Services Industry led the activity chart with 28.048 billion shares valued at N198.017 billion traded in 10,416 deals. Therefore, contributing 97.61% and 94.72% to the total equity turnover volume and value, respectively.

The Conglomerates Industry followed with 434.845 million shares worth 1.339 billion in 1,225 deals.

In third place was The Consumer Goods Industry, with a turnover of 74.111 million shares worth N2.853 billion in 3,835 deals.

Union Bank Of Nigeria Plc, Transnational Corporation Plc and FBN Holdings Plc were the three most traded equities during the week. The three accounted for a combined 27.841 million shares worth N193.488 billion in 1,872 deals and contributed 96.89% and 92.55% to the total equity turnover volume and value respectively.

The NGX All-Share Index depreciated by -1,177.06 index points, or 2.18% to close at 52,908.24 index points, down from 54,085.30 index points. While the market value of all listed equities stood at N28.523 trillion, representing a decline of N635 billion.

Similarly, all other indices finished lower with the exception of the NGX-Insurance, NGX AFr Div Yield and NGX Growth index which appreciated at 0.83%, 0.58% and 0.74% while, the NGX Asem index and NGX Sovereign bond closed flat.

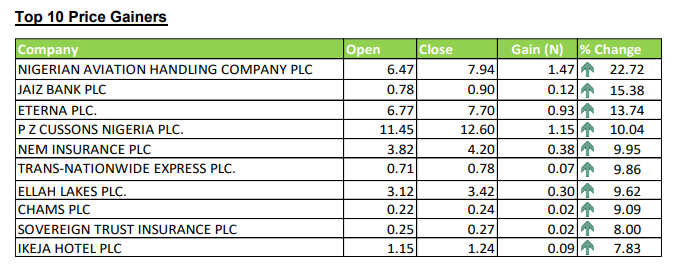

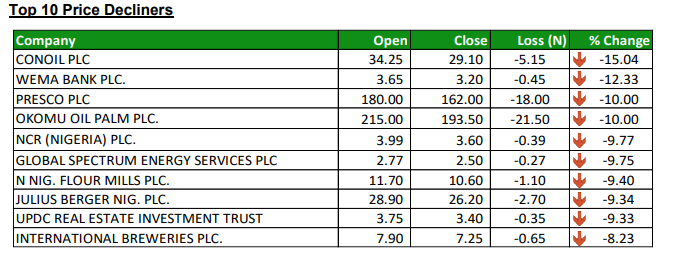

Thirty-six equities appreciated in price during the week, higher than twenty-three equities in the previous week. Forty-five equities depreciated in price, lower than fiftyfour equities in the previous week, while seventy-five equities remained unchanged lower than seventy-nine equities recorded in the previous week.