Nigerian Exchange Limited

Stock Investors Gain N596 Billion Last Week

Investors in the Nigerian Exchange Limited raked in N596 billion last week as activity jumped across the bourse on renewed interest in local stocks.

During the week, investors exchanged a total of 1.840 billion shares worth N27.286 billion in 27,273 transactions, against a total of 3.021 billion shares valued at N31.784 billion that exchanged hands in 29,153 deals in the previous week.

The Financial Services Industry led the activity chart with 1.286 billion shares valued at N10.745 billion traded in 12,379 deals. Therefore, contributed 69.90% and 39.37% to the total equity turnover volume and value, respectively. The Conglomerates Industry followed with 251.105 million shares worth 1.659 billion in 1,371 deals.

In third place was The Consumer Goods Industry, with a turnover of 105.601 million shares worth N2.522 billion in 4,263 deals.

Ecobank Transnational Incorporation, Jaiz Bank Plc and Access Holdings Plc accounted for 640.650 million shares worth N4.825 billion in 2,098 deals. The three accounted for a combined 34.81% and 17.68% to the total equity turnover volume and value, respectively.

The market value of all listed equities appreciated by N596 Billion to N29.158 trillion last week, up from the N28.562 trillion it settled in the previous week. The NGX All-Share Index gained 2.09% or 1,105.34 index points to close the week at 54,085.30 index points against 52,979.96 index points it closed in the previous week.

However, all other indices finished lower with the exception of the NGX-Main Board index which appreciated at 6.03%, while, the NGX Asem and NGX Sovereign bond indices closed flat.

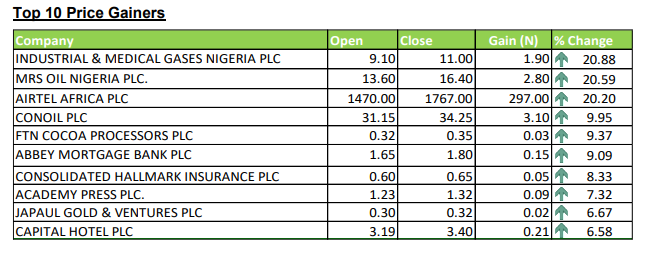

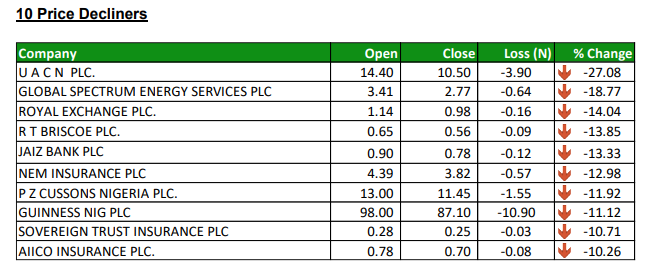

Twenty-three equities appreciated in price during the week, lower than thirty-seven equities recorded in the previous week. Fifty-four equities depreciated in price, higher than forty-two equities in the previous week, while seventy-nine equities remained unchanged higher than seventy-seven equities recorded in the previous week.

In May, the Exchange gained 8.96% despite the global rout and increase in interest rates in Nigeria and the rest of the world. In the second quarter so far, has appreciated by 15.16%. From the year to date, it has returned 26.61%.