Loans

Despite Majority’s Refusal To Pay Back, CBN Loans to Farmers Hikes to N1 Trillion

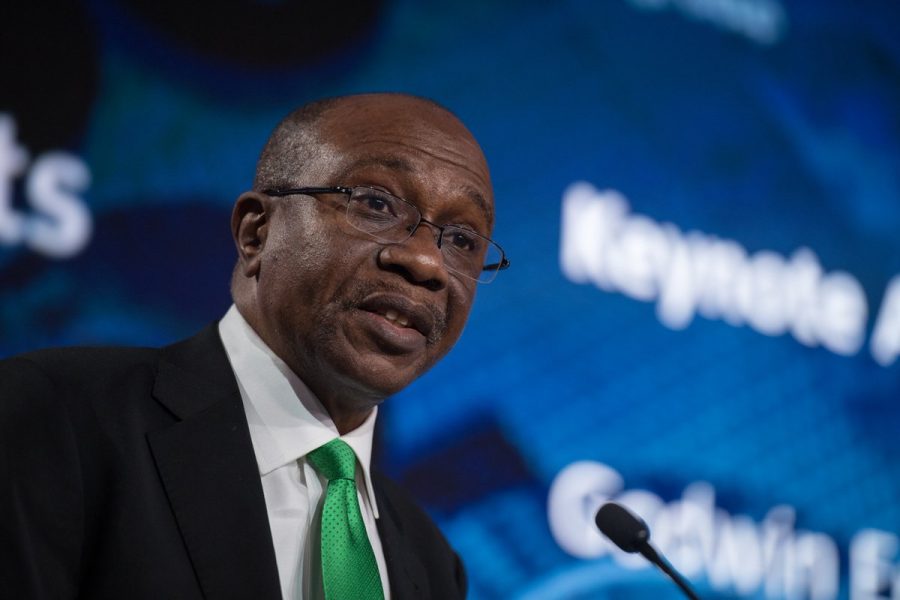

The Central Bank of Nigeria (CBN) has revealed that a sum of N1 trillion in loans has been disbursed to farmers across the country as of April despite the refusal of most beneficiaries to pay back.

Recall that Investors King reported CBN’s outcry over a majority of the farmers who benefited from the Anchor Borrower’s Programme (ABP), but refused to pay back.

Investors King gathered that the majority of the beneficiaries regard the loan as their part of the national cake and they do not have to pay back what they consider theirs as citizens. This attitude made it difficult for other farmers, who also want to access the loan, to benefit from the scheme.

According to figures gathered from the CBN’s Monetary Policy Committee members’ report, “Between January and February 2022, the bank disbursed N29.67bn under the Anchor Borrowers’ Programme for the procurement of inputs and cultivation of maize, rice, and wheat, three crops that hitherto were significant concerns of FX demand.

“These disbursements bring the total under the programme to over 4.52 million smallholder farmers, cultivating 21 commodities across the country, comes to a total of N975.61bn.”

The CBN stated in its most recent MPC report, “Between April and May 2022, the Bank released the sum of N57.91bn under the Anchor Borrowers’ Programme to 185,972 new projects for the cultivation of rice, wheat, and maize, bringing the cumulative disbursement under the programme to N1.01tn, disbursed to over 4.2 million smallholder farmers cultivating 21 commodities across the country.”

In its amended Anchor Borrowers’ Programme Guidelines for September 2021, the CBN’s Development Finance Department stated that insurance coverage should be given under the plan.

According to the instructions “Provide insurance cover for the projects; ensure fast processing and settlement of claims; provide technical advice to farmers on insurance policies; and monitor projects for early warning signals or red flags.

“Render periodic reports on-farm conditions; serve as member of the project management team; and carry out any other responsibilities as may be prescribed by the CBN from time to time.”

The updated rules took into account current realities and advancements in the ABP, with the goal of fostering best practices in program execution.

Smallholder farmers, the ABP transaction dynamics, and the project management team in the implementation phase were all recognized in the publication.

The recommendations, according to the CBN, are aimed at strengthening the program’s implementation process and increasing stakeholder participation in order to achieve the ABP’s goal.