Nigerian Exchange Limited

Global Stock Rout Has Nothing on Nigeria as Stock Investors Gain N1.2 Trillion Last Week

Investors in the Nigerian stock market pocketed a whopping N1.166 trillion last week as sentiment surged across the Exchange

Nigerian stock market extended its gains last week despite rising global uncertainty and a tremendous plunge in global stocks and market capitalisation of the unregulated cryptocurrency market. Investors in the Nigerian stock market pocketed a whopping N1.166 trillion last week as sentiment surged across the Exchange.

Checks by Investors King revealed that activity level on the Nigerian Exchange Limited (NGX) jumped in the week, with invetsors transacting 1.816 billion shares worth N27.194 billion in 36,286 deals, against a total of 1,598 billion shares valued at N19.603 billion that exchanged hands in 21,494 deals in the previous week.

Breaking down key sectors, the financial services industry led the activity chart with 904.860 million shares valued at N8.498 billion traded in 12,883 deals. Therefore, contributing 49.82% and 31.25% to the total equity turnover volume and value, respectively. The conglomerates Industry followed with 263.830 million shares worth N540.313 million in 1,651 deals.

In the third place, was the consumer goods industry, with a turnover of 238.964 million shares worth N5.816 billion in 7,635 deals.

Transnational Corporation Plc, Guaranty Trust Holding Company Plc and Jaiz Bank Plc were the three most traded stocks in the week under review. The three accounted for 459,179 million shares worth N3.294 billion that were traded in 3,645 deals and contributed 25.28% and 12.11% to the total equity turnover volume and value, respectively.

Market capitalisation of all listed stocks appreciated by N1.166 trillion or 4.25% from N27.460 trillion recorded in the previous week to N28.626 trillion last week. The NGX All-Share index also rose by 4.25% or 2,163.43 index points to 53,098.46 index points, up from 50,935.03 index points.

Similarly, all other indices finished higher with the exception of NGX Insurance, NGX AFR Div Yield, and NGX Sovereign bond indices which depreciated at 1.92%, 2.82%, and 0.02%, while, NGX Asem index closed flat.

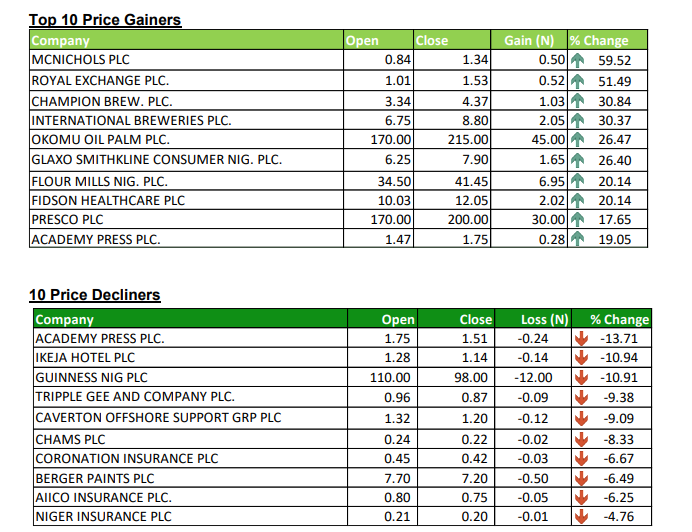

Fifty equities appreciated in price during the week, higher than Forty-nine equities in the previous week. Thirty-two equities depreciated in price, Unchanged from Thirtytwo equities in the previous week, while seventy-four equities remained unchanged lower than seventy-five equities recorded in the previous week.

Year to date, the Nigerian Exchange Limited has gained 59.52% despite global stock rout, compared to global stocks that have been on the decline since the beginning of the year. Dow Jones has shed 4,388.40 points, or

In Europe, the story is not different as STOXX Europe 600 closed at 432.88, a 11.66% decline from its January 1, 2022 opening price. In Tokyo, stock market has lost 9.40%, or 2,754.74 points of its value this year.

China is also not excluded as Shanghai Stock Exchange has dropped 558.58 points, or year to date. See the details of NGX top gainers and losers below.