Crude Oil

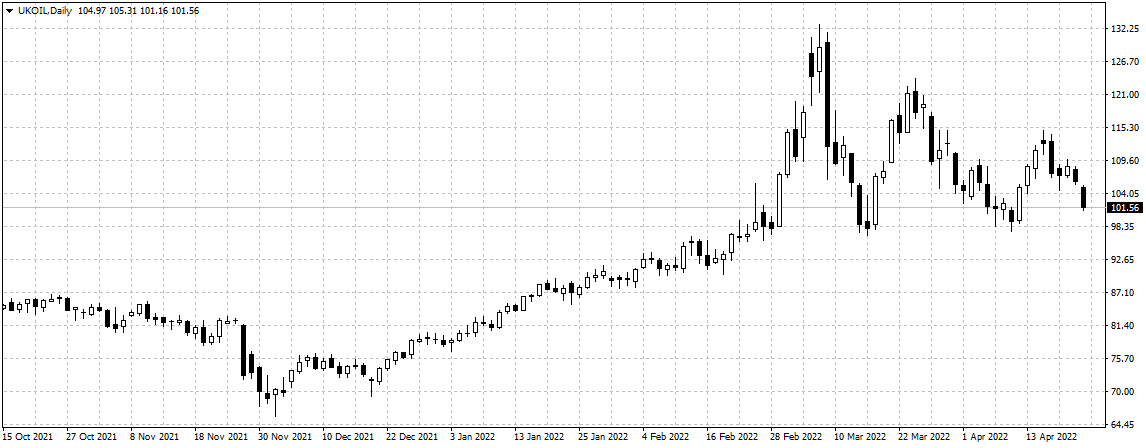

Brent Crude Drops to $101.31 on Rising COVID-19 in China

The international benchmark for crude oil, Brent crude declined from about $109 a barrel it closed on Friday to $101.31 on Monday during the London trading session as concerns over rising cases of COVID-19 in China weighed on the outlook of the commodity.

Chinese government was said to have started constructing fences around buildings that accommodated COVID-19 victims to curb the further spread of the virus. However, investors are concerned the measures may not be enough given a series of lockdown restrictions put in place in different cities. Businesses and investors have started predicting a total lockdown that could plunge the world back to the 2020 experience and slow down the global economy.

“Today, China fears are adding to the downside momentum for Asian markets. China has tightened parts of the Shanghai lockdown, including erecting fences around apartment buildings with Covid-19 infected individuals. Meanwhile, residents of the Chaoyang district of Beijing will have to submit to three days of testing to get on top of the omicron outbreak there, with parts of it “sealed” or “controlled,” to paraphrase Bloomberg’s story this morning. Although some parts of China have been under restrictions longer than Shanghai, omicron’s arrival in Beijing would be an ominous development,” Jeffrey Halley, a Senior Market Analyst, Asia Pacific with OANDA stated in an email forwarded to Investors King.

While, the size of the COVID-19 cases is unknown, continuous restrictions in the world’s largest importer of the commodity and the resumption of crude oil production in Libya‘s closed oil fields could cap oil price increase, even with the sanctions imposed on over 7 million barrels per day of Russian oil import.

Meanwhile, global stock markets extended their declines during the London trading session on Monday on the back of the U.S. Federal Reserve’s projected rates increase. Stoxx 600 Europe index lost more than 2% while S&P 500 dipped by 1%. The cryptocurrency space plunged further.

Bonds and the U.S. Dollar jumped ahead of Federal Reserve action.