Nigerian Exchange Limited

Stock Investors Gain N512 Billion This Week

Investors in the Nigerian Exchange Limited (NGX) gained N512 billion this week as the Exchange extended its bullish run recorded in the week ended April 14th, 2022, Investors King reports.

In the four-week trading days, due to the Easter Monday holiday, investors transacted a total of 1.302 billion shares worth N17.813 billion in 20,212 deals, in contrast to a total of 1.247 billion shares valued at N22.372 billion that exchanged hands in 23,406 deals last week.

Breaking down each sector, the Financial Services Industry led the activity chart with 836.781 million shares valued at N6.007 billion traded in 9,527 deals. Therefore, contributing 64.28% and 33.72% to the total equity turnover volume and value respectively. The Oil and Gas Industry followed with 86.909 million shares worth N1.243 billion in 1,770 deals. In third place was The Consumer Goods Industry, with a turnover of 86.286 million shares worth N2.225 billion in 3,056 deals.

Fidelity Bank Plc, Zenith Bank Plc and Universal Insurance Plc were the three most traded equities during the week. The three accounted for a combined 279.507 million shares worth N2.627 billion in 2,504 deals and contributed 21.47% and 14.75% to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 2.00% or 949.27 index points to 48,459.65 index points from 47,510.38 index points recorded last week. The market value of all the listed equities appreciated by N512 billion to N26.125 trillion.

Similarly, all other indices finished higher with the exception of NGX Insurance, which depreciated at 0.05% while NGX Asem, NGX Afr. bank value and NGX Growth indices closed flat.

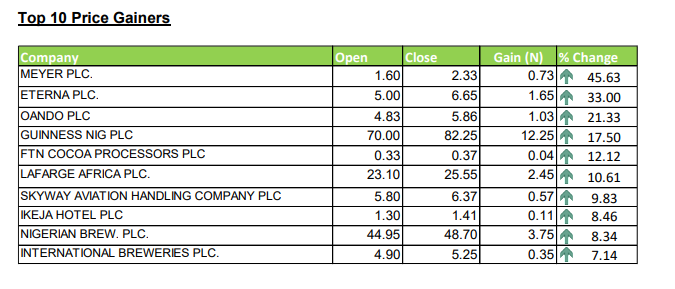

Fifty equities appreciated in price during the week, lower than fifty-one equities in the previous week. Twenty-nine equities depreciated in price, higher than eighteen equities in the previous week, while seventy-seven equities remained unchanged lower than eighty-seven equities recorded in the previous week.