Nigerian Exchange Limited

Nigerian Stock Investors Lose Another N58 Billion Last Week

The stock rout in the Nigerian equities market continued last week as investors lost another N58 billion after losing N172 billion in the previous week.

During the week, investors exchanged 1.289 billion shares worth N13.546 billion in 22,118 deals, against a total of 1.176 billion shares valued at N16.601 billion that exchanged hands in 21,076 transactions in the previous week.

The Financial Services Industry led the activity chart with 851.598 million shares valued at N7.516 billion traded in 11,930 deals, therefore contributing 66.07% and 55.49% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 174.588 million shares worth N569.028 million in 1,095 deals. The third place was The ICT Industry, with a turnover of 77.571 million shares worth N2.249 billion in 1,458 deals.

Fidelity Bank Plc, Transnational Corporation Of Nigeria Plc, and Access Holdings Plc were the three most traded equities in the week under review, accounting for a combined 426.566 million shares worth N1.777 billion in 3,307 deals. The three contributed 33.10% and 13.12% to the total equity turnover volume and value, respectively.

The NGX All-Share Index depreciated by 0.23% or 121.37 index points from 46,964.23 index points filed in the previous week to 46,842.86 index points last week. Market capitalization also declined by 0.26% or N58 billion to close the week at N25.253 trillion.

Similarly, all other indices finished lower with the exception of NGX Premium, NGX Lotus II and NGX Sovereign bond indices which appreciated by 1.31%, 1.38% and 0.56% respectively. While NGX Asem and NGX Growth indices closed flat.

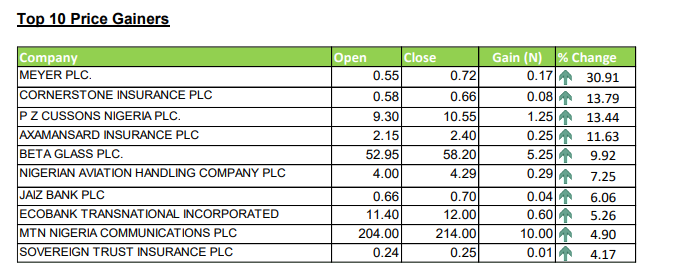

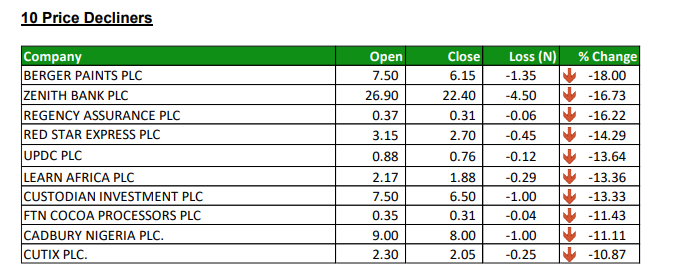

Twenty equities appreciated in price during the week, lower than Twenty-four equities in the previous week. Fifty equities depreciated in price, Higher than Forty-four equities in the previous week, while Eighty-six equities remained unchanged lower than Eighty-eight equities recorded in the previous week.

The Exchange year-to-date return moderated to 9.66%. See the details of top gainers and losers below.