Nigerian Exchange Limited

Stock Market Year-to-Date Return Decline With Activity Last Week

Trading at the Nigerian stock market continues to moderate last week amid rising inflation rate, duty fees and other economic uncertainties.

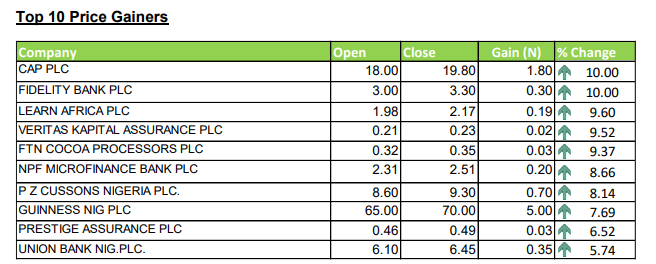

Cap Plc and Fidelity Bank led gainers as investors exchanged 1.176 billion shares worth N16.601 billion in 21,076 deals during the week, against a total of 2.449 billion shares valued at N20.653 billion that exchanged hands in 20,764 deals in the previous week.

Breaking down top sectors, Investors King observed that the Financial Services Industry led the activity chart with 954.472 million shares valued at N10.217 billion traded in 12,700 deals, therefore contributing 81.14% and 61.55% to the total equity turnover volume and value, respectively. The Consumer Goods Industry followed with 63.728 million shares worth N3.439 billion in 2,720 deals. In third place was The Conglomerates Industry, with a turnover of 53.313 million shares worth N258.568 million in 711 deals.

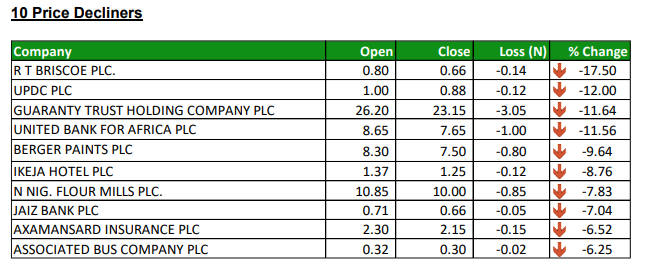

Fidelity Bank Plc, United Bank For Africa Plc, and Guaranty Trust Holding Company Plc were the three most traded equities last week. The three accounted for a combined 456.971 million shares worth N4.469 billion in 4,982 deals and contributed 38.85% and 26.92% to the total equity turnover volume and value, respectively.

The market value of listed equities depreciated by 0.67% or N172 billion to N25.311 trillion last week. The gauge of the Exchange, the NGX All-Share Index also shed 0.67% or 318.44 index points to 46,964.23 index points.

Similarly, all other indices finished lower with the exception of NGX AFR Div Yield and NGX Meri Growth indices, which appreciated by 1.81% and 0.01% respectively While NGX ASeM and NGX Growth indices closed flat.

In the week, Twenty-four equities appreciated in price during the week, higher than Twenty-one equities in the previous week. Forty-four equities depreciated in price, lower than Forty-five equities in the previous week, while Eighty-eight equities remained unchanged lower than Ninety equities recorded in the previous week.

The Exchange year-to-date moderated from 10.69% in the previous week to 9.94% last week.