Investment

Analysis Shows Hedge Fund Industry is Booming

Highlights

- 67% of all hedge funds globally and 70% of all new fund launches are US-based

- Crypto hedge funds appear for the first time in the top 10 of hedge fund strategies

- 22% of hedge funds apply a purely quantitative investment process and ca. 2% use artificial intelligence

An in-depth analysis compiled by quant technologies provider SigTech, reports that after continued expansion in 2021, there are currently 27,255 active hedge funds globally.

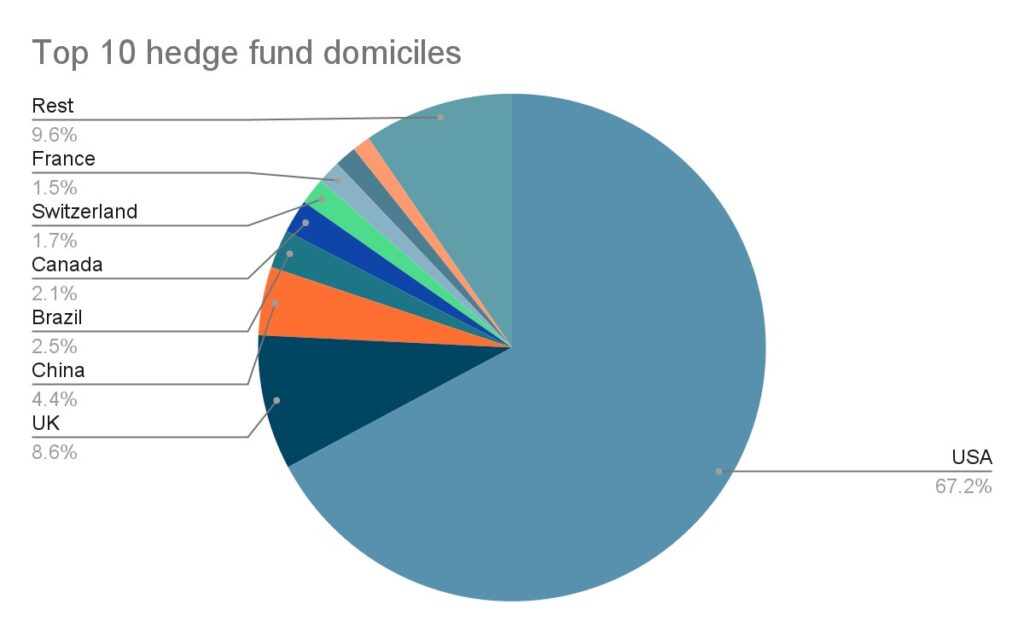

Geographical breakdown

The hedge fund industry remains dominated by the US market, which is home to 67% of all hedge funds globally, followed by 9% in the UK, 4% in China, and ca. 2% each in Brazil, Canada and Switzerland.

When it comes to the cities that have the largest concentration of hedge funds, unsurprisingly New York is the clear leader with nearly 7,000 funds (25.0% of total), followed by London with over 2,000 (8.2%), and Hong Kong with nearly 1,000 (3.6%).

Top 10 cities No. of hedge funds % of total hedge funds

New York 6,801 25.0%

London 2,230 8.2%

Hong Kong 978 3.6%

Boston 931 3.4%

Chicago 786 2.9%

Greenwich (USA) 682 2.5%

San Francisco 677 2.5%

Los Angeles 482 1.8%

São Paulo 448 1.6%

Toronto 395 1.4%

Daniel Leveau, VP Investor Solutions at SigTech, comments: “Our analysis reveals a strong and vibrant global hedge fund industry. Despite a healthy growth in emerging hedge fund centers, US-based managers continued to dominate the industry, both in absolute numbers and in terms of new fund launches.

Strategy breakdown

The most popular hedge fund strategy is Equity Long/Short, followed by Multi Strategy, Equities others (e.g., long bias, short bias), Fixed Income Credit and Event Driven. The fast-growing sub-strategy Crypto now makes up ca. 3% of all hedge funds. Also noteworthy is that 22% of the world’s hedge funds apply a purely quantitative investment process and ca. 2% claim to use artificial intelligence.

Top 10 hedge fund strategies No. of hedge funds % of total hedge fund strategies

Equity Long/Short 6,925 26.0%

Multi Strategy 4,899 18.4%

Equities others 3,120 11.7%

Fixed Income Credit 3,004 11.3%

Event Driven 2,004 7.5%

Managed Futures 1,780 6.7%

Macro 1,450 5.4%

Relative Value 1,377 5.2%

Alternative Risk Premia 997 3.7%

Crypto 774 2.9%

New hedge fund launches

On the backdrop of a strong performing hedge fund sector, new fund launches remain strong, with nearly 2,000 new launches per year on average since 2019. Of the 5,500 new hedge funds launched since 2019, 70.2% are based in the US, 9.3% in the UK and 5.2% in China.

Top 5 countries for hedge fund

launches since 2019 No. of hedge fund launches % of total

USA 3,859 70.2%

UK 512 9.3%

China 287 5.2%

Brazil 127 2.3%

Canada 101 1.8%

The most popular strategy for these new funds is Equity Long/Short, followed by Fixed Income Credit, Equity others (e.g. long bias, short bias) and Multi Strategy.

Top 10 hedge fund strategies No. of hedge funds % of total

among fund launches

Equity Long/Short 1,059 19.3%

Fixed Income Credit 515 9.4%

Equity others 394 7.2%

Multi Strategy 348 6.3%

Crypto 310 5.6%

Event Driven 244 4.4%

Relative Value 241 4.4%

Macro 238 4.3%

Managed Futures 133 2.4%

Alternative Risk Premia 38 0.7%

Leveau adds: “The robust level of new hedge fund launches reflects a sustained strong demand from investors for innovative and uncorrelated investment strategies to meet return expectations in an increasingly challenging market environment. Hedge fund growth shows no signs of abating, fuelled by the ever-increasing investment opportunities in the market, and the growth of new data and tools available to these funds.”

Crypto hedge funds on the rise

In 2021, a record number of 171 crypto hedge funds were launched. In total, there are now 774 hedge funds focused on crypto, with the US again being the driver of innovation with 80% of these funds domiciled in the US.

Daniel Leveau says, “We are investing heavily in our quant technology platform to satisfy the strong demand from hedge funds looking to accelerate their data-driven investment processes.

Alongside the growing hedge-fund community, SigTech enjoyed strong growth in 2021. Clients with a combined AUM of over $5 trillion are now using our platform, including some of the world’s leading hedge funds, as well as recently launched start-up systematic funds.”

About SigTech

SigTech offers a future-proof quant trading platform to global investors. Cloud-hosted and Python-based, the platform integrates a next-gen back test engine and analytics with curated datasets covering equity, rates, FX, commodity, and volatility. SigTech eliminates the expensive upfront costs of infrastructure build-out, giving clients an edge in alpha generation from day one.

The SigTech platform was originally built over seven years to manage systematic investments at Brevan Howard, which remains a SigTech client today. After the spinoff into an independent company in 2019, the team has grown substantially and established SigTech as the leading provider of quant technologies.