Nigerian Exchange Limited

NGX All-Share Index Appreciates 0.36% Last Week

The equities market rebounded from two weeks of consecutive declines to post a 0.36% gain last week as 36 equities appreciated in price during the week, Investors King reports.

Activity at the Nigerian Exchange Limited (NGX) improved during the week when compared to the previous week. Investors exchanged at 2.798 billion shares worth N23.859 billion in 22,970 deals during the week, in contrast to a total of 1.374 billion shares valued at N23.786 billion that exchanged hands last week in 28,809 deals.

The Financial Services Industry led the activity chart with 2.398 billion shares valued at N14.030 billion traded in 11,900 deals, therefore contributing 85.69% and 58.80% to the total equity turnover volume and value, respectively. The Conglomerates Industry followed with 73.381 million shares worth N305.944 million in 996 deals.

In third place was The Consumer Goods Industry, with a turnover of 60.832 million shares worth N3.087 billion

in 2,707 deals.

FCMB Group Plc, Unity Bank Plc, and FBN Holdings Plc were the three most traded equities last week, accounting for a combined 1.633 billion shares worth N5.486 billion in 1,395 deals. Together, the three contributed 58.36% and 22.99% to the total equity turnover volume and value, respectively.

The NGX All-Share index appreciated by 0.36% to 47,437.48 index points while the market value of all listed equities grew by N91 billion from N25.475 trillion recorded in the previous week to N25.566 trillion in the current week.

Similarly, all other indices finished higher with the exception of NGX Consumer goods, NGX Oil/Gas and NGX Industrial Goods, which depreciated by 0.52%, 2.22% and 0.13%, respectively. While NGX AseM, NGX Growth and NGX Sovereign bond indices closed flat.

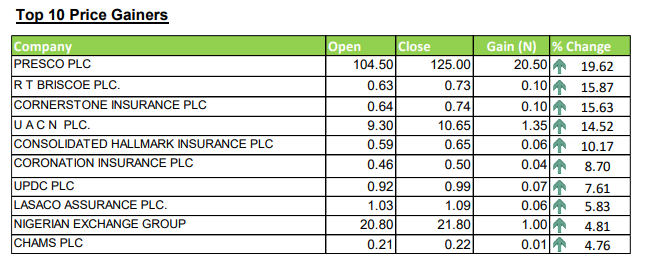

Thirty-six equities appreciated in price during the week, higher than Twenty-two equities in the previous week. Thirty-three equities depreciated in price, lower than Forty-nine equities in the previous week, while Eighty-seven equities remained unchanged higher than Eighty five equities recorded in the previous week.

The Exchange’s year-to-date return rose to 11.05% last week. See below for details of top gainers and losers.